The Bank of England’s reputation has taken a severe hit as previously unreleased minutes reveal staff knew their dire “No Deal” Brexit predictions “could be misleading” and “against [the] public interest.”

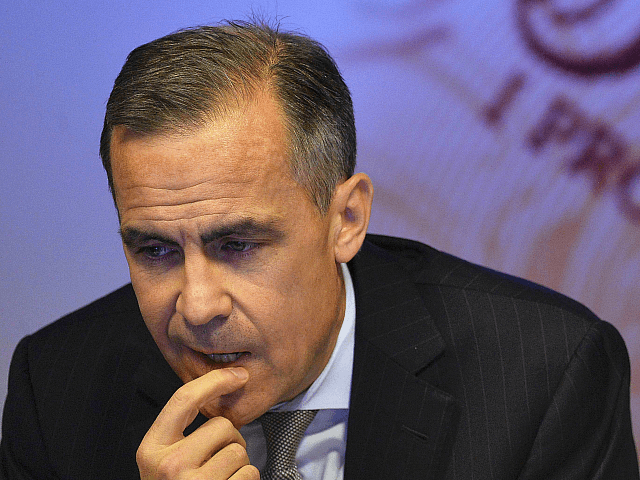

The central bank has been under fire from Brexiteers since publishing a “No Deal” scenario in which GDP collapses by 8 per cent in a year, as has its Canadian governor, Mark Carney — a controversial former employee of the Goldman Sachs banking corporation which ploughed hundreds of thousands of pounds into the Remain campaign during the EU referendum, along with several other multinational financial giants.

Even former members of the Bank of England’s Monetary Policy Committee (MPC) such as Andrew Sentance — a committed Remainer — stepped forward to say the prediction was not a “real-world scenario,” and suggested it was “undermining its credibility and independence” by publishing such “extreme scenarios and forecasts.”

Now The Telegraph has revealed that the Bank knew full well that its reports could be “against [the] public interest” by giving “a suggestion of apparently precise scenarios [which] could be misleading and liable to misinterpretation,” citing previously unreleased minutes.

Governor Carney tried to defend the “scenarios” by suggesting that they were intended to “illustrate what could happen not necessarily what is most likely to happen” — but it is notable that they did not think to consider a single scenario in which Brexit led to a positive outcome for the United Kingdom.

I can barely believe I'm reading this graph. Has something gone wrong with my eyes? Does it really say the Bank of England forecasts that no deal means an 8% contraction in UK GDP in under a year? WTH?? I mean…WTH is that?!? Is that supposed to be economics? pic.twitter.com/1mktHVAKGQ

— Andrew Lilico (@andrew_lilico) November 28, 2018

Governor Carney, who is also a member of the secretive General Council of the European Central Bank, has long been at loggerheads with Brexit-supporting parliamentarians who believe he has “politicised” his role, with European Research Group (ERG) frontman Jacob Rees-Mogg describing him in uncharacteristically scathing terms as “a second-tier Canadian politician who failed to get on in Canadian politics and got a job in the UK” and calling for his resignation.

Instead, the Remainer-dominated Government has repeatedly extended his term.

During the 2016 referendum on Britain’s membership of the European Union, the central bank boss lent his implicit support to then-Chancellor of the Exchequer George Osborne’s claims that a Leave vote would have an immediate negative impact on the economy, suggesting that it “could” spark a technical recession.

In fact, the British economy has continued to grow since the Leave vote, frequently outpacing continental rivals firmly embedded in the EU and enjoying record low unemployment — leading Bank of England chief economist Andrew Haldane to concede that their pre-referendum anti-Brexit forecasts have been a “Michael Fish moment”.

COMMENTS

Please let us know if you're having issues with commenting.