UK companies can expect a surge in dealmaking this year as the nation retains its place as the third most favourable destination for companies to invest.

Sixty per cent of UK businesses are expected to pursue mergers and acquisitions in the next year – the highest level since 2009 and above the global average (56 per cent).

According to a report by the accountancy giant EY, covered in The Times, only China and the U.S. are more favourable destinations for companies to invest.

The UK fell out of the top five for the first time in the report’s seven-year history last October, but shot back up to third place by April.

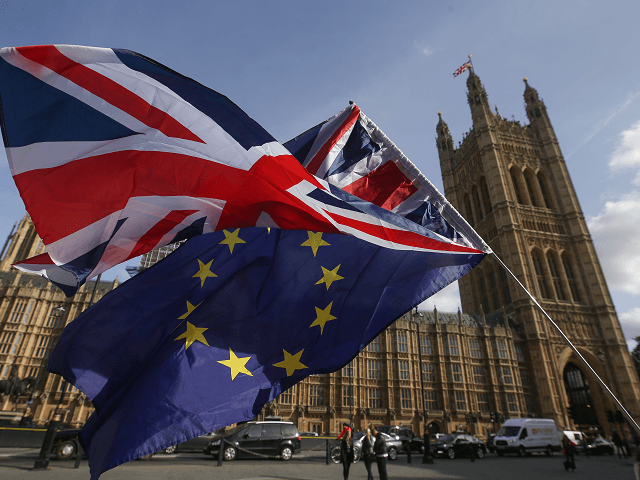

The figures demonstrated that investors were attracted by Britain’s open economy and its assets, despite the “maelstrom of change” since the Brexit vote, claimed Steve Ivermee, author of the report.

“We’d expect a very active M&A market, especially on the domestic front, as firms look to innovate but also defend against rising costs,” he added.

Brexit Boom: World Bank Ranks UK Far Above Germany, France, Manufacturing Strengthens https://t.co/3JVmnpmwZi

— Breitbart London (@BreitbartLondon) November 1, 2017

The fall in the value of the pound – of around 10 per cent since the Brexit vote – is making the UK more attractive for foreigner buyers and investors, it is claimed.

British businesses are also investing abroad and buying up foreign competitors, with outbound deals totalling £52.1 billion in the first six months of the year. UK firms have been targeting their American, French, German, and Indian rivals.

The news comes as Mark Carney, the governor of the Bank of England, claims that Britain “would be booming” if it were not for Brexit.

Speaking on ITV’s Peston on Sunday, the opponent of Brexit said investors were waiting for the outcome of Brexit negotiations before making investment decisions, which was slowing down economic growth.

“Since the referendum, what we’re seeing is that business investment has picked up, but it hasn’t picked up to any of the extent that one would have expected given how strong the world is, how easy financial conditions are, how high profitability is, and how little spare capacity they have,” he said.

COMMENTS

Please let us know if you're having issues with commenting.