If President Obama’s master plan is to develop Iran into a regional super-power, settling the Middle East’s sectarian problems through Shiite conquest, then his nuclear deal was a major step forward.

Not only will the world’s largest sponsor of terrorism net $150 billion from sanctions relief – which is something like a 35 percent increase in their Gross Domestic Product! – but its Sunni enemies, the Gulf oil states, lost almost $40 billion in a market panic on Sunday, the beginning of the market week in the Middle East.

The UK Telegraph attributes the market crash to Gulf fears that “the lifting of economic sanctions against Iran threatened to unleash a fresh wave of oil onto global markets that are already drowning in excess supply.”

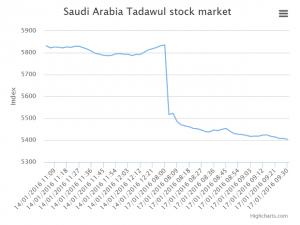

The hit to Saudi Arabia’s stock market, which fell to a five-year low despite a last-minute recovery, makes for a particularly arresting graph:

“The Qatar stock exchange, fell 7.2pc to close at 8,527.75, and the Abu Dhabi Securities Exchange shed 4.24pc to finish at 3,787.4. The Kuwait market returned to levels not seen since May 2004 as it slid 3.2pc lower, while smaller markets in Oman and Bahrain dropped 3.2pc and 0.4pc respectively,” the Telegraph reports.

The hit reached into other markets, as the prospect of an Iranian supply tidal wave and plunging oil prices caused banks like Standard Chartered, Goldman Sachs, RBS, and Morgan Stanley to downgrade their outlooks.

As for Iran, its stock index gained 1 percent, making it “one of the best performing markets in the world with gains of 6pc since the start of the year.”

Iran’s official news agency reported that it plans to ramp oil production back up to pre-sanction levels, increasing oil exports by 500,000 barrels, on a very short timetable. In the longer term, the Islamic Republic plans to ship 2 million barrels a day.

USA Today anticipates the Iranian flood could bring oil down to less than $20 a barrel… which, as the UK Independent wryly notes, is substantially less than the cost of an actual empty barrel. The price of oil could sporadically drop below the cost of designer bottled water.

USA Today explains how Obama’s nuclear deal gives Iran a decisive advantage over both the Gulf states and American oil companies:

Even though Iran was under sanctions, it was able to sell limited amounts of oil to a few select countries — China, India and a few other Asian nations. Now, it faces no limitations. Plus, Iran is able to produce oil at lower overall “lifting costs” than many other nations, as little as $10 a barrel. Even when oil prices are absurdly low, it is one of the countries that can still make money.

That puts American producers at a huge disadvantage, pushing many out of the market.

On the other hand, some analysts think Iran lacks the technology and infrastructure necessary to sustain the output levels they’re boasting about, and there wouldn’t be enough storage capacity in the entire world to hold the excess inventory.

This led some market-watchers to predict prices would rise and stabilize after a few wild months, especially if it soon becomes clear that Iran cannot pump out as much oil as their ministers are promising. Reuters notes that Iran has a large amount of oil stored for immediate delivery, but after that initial flood is released, it will probably take time to install the new technology necessary for a huge increase in production and delivery.

The other possible savior of the oil market is China, whose demand hit record highs in 2015. Reuters reports data on Chinese demand was encouraging enough to lift oil prices by 3 percent on Tuesday.

However, there are still concerns about the long-term health of the Chinese economy, and analysts quoted by Reuters were not optimistic that China’s demand would produce more than a slight bump in prices, if Iran comes anywhere near the export goals it has announced.

In fact, a deeply pessimistic Abhishek Deshpande of Natixis declared, “It’s not looking good. There is no reason to believe why and how prices will recover by the end of 2017.”

COMMENTS

Please let us know if you're having issues with commenting.