The latest evidence that President Donald Trump’s trade war is not the disaster “experts” predicted came via the Wall Street Journal on Tuesday: investors are moving their money into the United States as Trump’s aggressive policies destabilize competing markets.

The Wall Street Journal tells us the American market is far tougher than the authoritarian states that were supposed to easily defeat us in tariff battles:

The White House’s recent actions on trade and international sanctions have amplified steep declines across markets in Turkey, Russia and China at a time emerging economies were already grappling with a stronger dollar and decelerating global growth.

U.S. stocks have beaten foreign stocks in part as investors seek a more stable market during the rocky period, analysts say. Strong U.S. economic and earnings growth has helped. While the S&P 500 has risen 4.5% this quarter and is trading within roughly 1% of its all time high, the MSCI AC World ex-USA Index has fallen 1.3% this quarter and is down nearly 7% for the year so far.

“Whether it’s sanctions, tariffs or central-bank policy…it seems the U.S. equity market reacts quite calmly, and most of the action is happening outside the United States,” said Ed Keon, Newark, N.J.-based chief investment strategist at QMA, a unit of Prudential Financial.

The U.S. has also regained its crown as the most favored region for stocks for the first time in five years, according to fund managers surveyed by Bank of America Merrill Lynch.

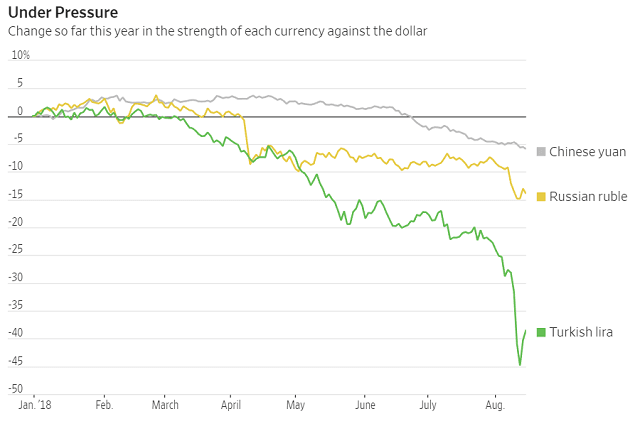

The Journal included a graph showing how the currencies of China, Russia, and Turkey fared against the U.S. dollar this year:

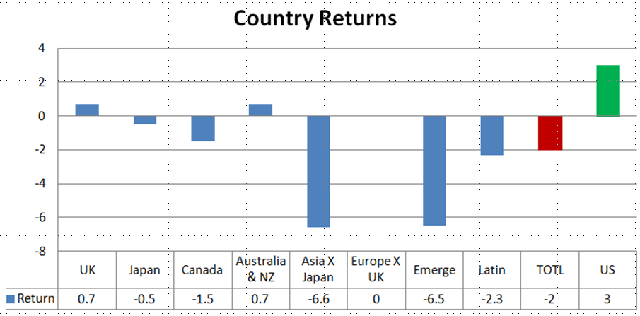

Nasdaq noted in July that American stocks dramatically outperformed the rest of the world in the first half of 2018, particularly in the case of smaller companies. The cheery green bar on the right side of a dour blue and red graph is America:

Of course, there are cautionary notes that beneficial conditions for U.S. markets might not last forever, but the tenor of those warnings is very different from the confident assurances of certain doom heard last year. Back then, the argument was that the American economy would immediately go into a tailspin and consumer prices would soar, kneecapping the Trump boom in jobs and GDP growth, while authoritarian competitors would laugh and force their people to suffer at gunpoint until the foolish Americans cried “uncle.”

Now opponents of Trump’s policy advise not to hit Turkey too hard lest it collapse and drag the European Union down with it. The Street on Tuesday congratulated American banks for largely steering clear of the Turkish sinkhole, while European investors poured billions into what they thought was a vibrant emerging economy with stable political leadership.

The WSJ worries that if tensions ease, foreign markets could quickly catch up to the United States — in other words, the United States would lose its edge if it eases up on the economic pressure it has been applying. There are also concerns the dollar could grow too strong, putting U.S.-based multinational corporations at a disadvantage.

China was supposed to be invincible, but its currency just hit a 15-month low against the dollar; its markets slid by another two percent, its top companies are filing disappointing earnings reports, and the Communist Party has gone from confidently predicting trade-war victory to whining to the World Trade Organization about unfair U.S. tariffs on solar panels.

“Europe, closely tied to both the U.S. and emerging markets for trade, has suffered, too, with the Stoxx Europe 600 down 1% for the year and the auto sector, the target of threatened tariffs, among the biggest decliners,” the Wall Street Journal added.

One reason the doomsayers were wrong is that American media outlets have a long history of believing confident bluster from authoritarian states, all the way back to confident predictions that fascism would clean the free market’s clock and Soviet communism was the unbeatable economic model of the future. The Chinese are noticing that much of what their leadership told them about the strength of their economy was untrue, and they are as unhappy about it as their brutally repressive government allows them to be.

American media outlets are noticing as well. The New York Times reported China’s leaders were “supremely confident that they can win a trade war with President Trump” in April. The article included this summary of the analysis provided by experts quoted in the piece, written as a simple statement of fact rather than editorial opinion:

In the political realm, however, Mr. Xi enjoys advantages that may allow him to cope with the economic fallout far better than Mr. Trump can. His authoritarian grip on the news media and the party means there is little room for criticism of his policies, even as Mr. Trump must contend with complaints from American companies and consumers before important midterm elections in November.

The Chinese government also has much greater control over the economy, allowing it to shield the public from job cuts or factory closings by ordering banks to support industries suffering from American tariffs. It can spread the pain of a trade war while tolerating years of losses from state-run companies that dominate major sectors of the economy.

The very same New York Times writer, Steven Lee Myers, collaborated on a very different story about the current situation published on Monday, titled, “Trump’s Trade War Is Rattling China’s Leaders”:

China’s leaders have sought to project confidence in the face of President Trump’s tariffs and trade threats. But as it becomes clear that a protracted trade war with the United States may be unavoidable, there are growing signs of unease inside the Communist political establishment.

In recent days, officials from the Commerce Ministry, the police and other agencies have summoned exporters to ask about plans to lay off workers or shift supply chains to other countries.

With stocks slumping and the currency dropping 9 percent against the dollar since mid-April, censors have been deleting a torrent of criticism online, some of it directed at President Xi Jinping’s leadership.

Midway through the piece is a summary that bears absolutely no resemblance to what the NYT and its contributors told us four months ago:

If the trade war escalates — and Mr. Trump has shown no sign of backing down — some worry that the public’s faith in the economy could be shaken, exposing the nation to much more serious problems than a drop in exports. New economic data on Tuesday showed slower growth in investment and consumer spending, and there are fears that the financial crisis in Turkey could spread.

China’s leaders have argued that they can outlast Mr. Trump in a trade standoff. Their authoritarian system can stifle dissent and quickly redirect resources, and they expect Washington to be gridlocked and come under pressure from voters feeling the pain of trade disruptions.

But the Communist Party is vulnerable in its own way. It needs growth to justify its monopoly on power and is obsessed with preventing social instability. Mr. Xi’s strongman grip may be hindering effective policymaking, as officials fail to pass on bad news, defer decisions to him and rigidly carry out his orders, for better or worse.

To be sure, conditions can change, events beyond the control of any single government can shift the global economic winds, and we are only partway through a long economic struggle that began long before President Donald Trump took office.

Triumphalism would be a grave mistake, but it is time for some of the more strident trade-war alarmists to admit they judged the economic situation less accurately than Trump and his top advisers, in part because they believed claims of authoritarian strength and American weakness that Trump shrewdly doubted.

COMMENTS

Please let us know if you're having issues with commenting.