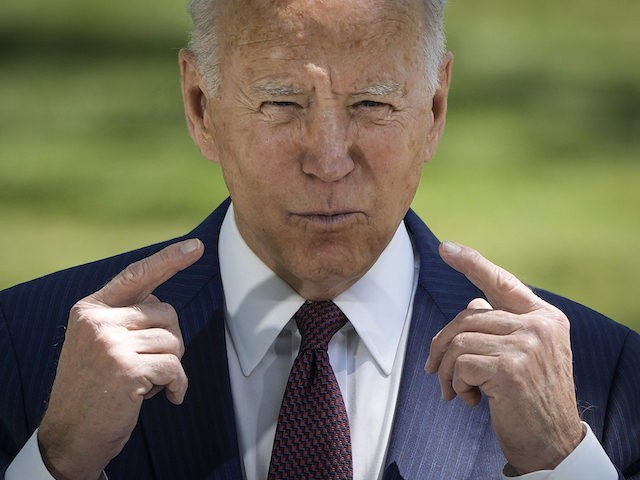

President Joe Biden will introduce a reported $1.8 trillion American Families Plan, or “human infrastructure” proposal, Wednesday in nearly a 5000-word speech to Congress.

The human infrastructure plan includes $109 billion for free college tuition for Dreamers, free two-year community college for all, free universal pre-K, free aid for minority-serving institutions, a free family leave program, and an expansion of the Child Tax Credit, according to a report.

An administration official purportedly told the Daily Mail Tuesday:

There is a wealth of economic research that shows that the investments proposed in the American Families Plan will yield significant economic returns, boosting productivity and economic growth, producing [a] larger, more productive, and healthier workforce on a sustained basis, and generating savings to state … and federal government.

To pay for the social welfare expansion, Biden intends to tax the rich by collecting $700 billion over ten years partly through stricter IRS enforcement tactics. As reported by the Daily Mail, Biden also plans to:

- Focus on corporations and high-worth individuals who may be hiding income with new disclosure requirements for large companies, businesses estates, and higher-income individuals, where the majority of the underreporting and tax noncompliance currently is.

- Reverse the 2017 tax cuts so to raise the top marginal income tax rate on wealthy Americans to 39.6 percent – up from 37 percent – with a focus on those in the top one percent.

- Raise capital gains tax rates for households that earn more than $1 million a year.

- He will also close a loophole known as ‘step up basis’ that allows the wealthy to escape taxes on accumulated gains when they leave it to their heirs but will exempt family-owned businesses and farms when given to heirs who will continue to run them.

Biden will deliver his speech, maskless, to about 200 people — 1,400 invitees short of a traditional speech of this magnitude due to the coronavirus, at the behest of House Speaker Nancy Pelosi (D-CA).

Both the House and the Senate, however, have gathered in their respective chambers during coronavirus for impeachment and swearing-in.

COMMENTS

Please let us know if you're having issues with commenting.