The Internal Revenue Service (IRS) has said it will increase its audit rates of wealthy taxpayers and large corporations by 50 percent.

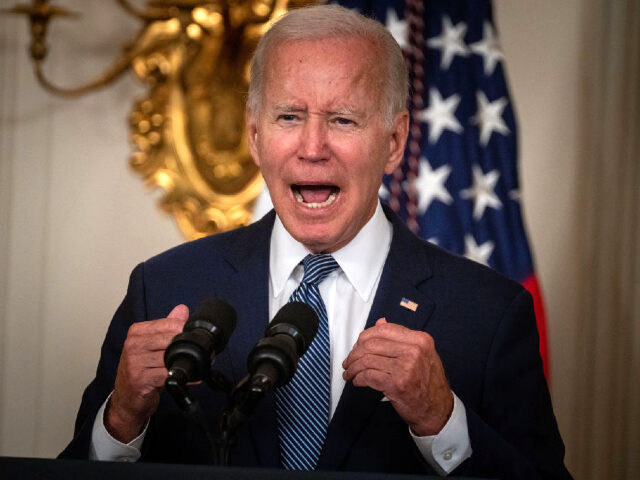

The IRS will reportedly be using funds allotted to it under the Inflation Reduction Act, which President Biden signed into law in 2022.

“The audit rate of taxpayers earning more than $10 million is expected to increase by 50%, going up from 11% in 2019 to 16.5% in 2026,” reported CNN.

“The IRS also plans to triple the audit rates of large corporations with assets over $250 million, as well as increase the audit rates of business partnerships with assets over $10 million by tenfold over the seven-year period,” it added.

The IRS, however, clarified that it does not expect the audit rates to actually exceed the numbers reached in 2010 “because the number of filings by large corporations, partnerships and wealthy individuals have grown and become more complex.”

Republicans believe the IRS will likely be using this expansion and funding to penalize middle-class Americans. IRS Commissioner Danny Werfel said the agency will leave Americans earning less than $400,000 annually alone.

Pressed by Fox News’ Peter Doocy, WH Press Sec. Karine Jean-Pierre promises the new IRS funding in the Inflation Reduction Act will only be used to target wealthy tax cheats.

Doocy: “So no new audits on anyone making under 400,000 a year?”

Jean-Pierre: “No. Very clear. No.” pic.twitter.com/vJZn9CHIPT

— The Recount (@therecount) August 9, 2022

“As I’ve said over and over again, there is no new wave of audits coming for middle- and low-income (taxpayers), coming for mom-and-pops. That is not in our plans in any way, shape or form,” Werfel said.

As Breitbart News reported this past December, the IRS increased the tax penalty for underpayments to eight percent after it had hired 87,000 new agents.

White House Council of Economic Advisers member Jared Bernstein told CNBC’s Squawk Box in 2022 that he does not expect more audits on middle class Americans.

“How much of this is going to be just IRS tax collection? They want to double the size of the IRS. I understand the industry has been shrunk, gutted, in some people’s words. And do you expect increased audits on the middle class?” co-host Brian Sullivan asked.

“Certainly not on the middle class. Remember, one of the lines in the sand, for all his flexibility,” responded Bernstein. “President Biden has always maintained that no one under 400,000 will pay one penny more in taxes. So, line in the sand there. Look, in terms of closing the tax gap, that’s what you’re talking about here, something like 80 billion for the IRS, this raises something like 200 billion over ten years and some people call that a conservative estimate.”

Paul Roland Bois directed the award-winning Christian tech thriller, EXEMPLUM, which can be viewed for FREE on YouTube or Tubi. “Better than Killers of the Flower Moon,” wrote Mark Judge. “You haven’t seen a story like this before,” wrote Christian Toto. A high-quality, ad-free rental can also be streamed on Google Play, Vimeo on Demand, or YouTube Movies. Follow on X @prolandfilms or Instagram @prolandfilms.

COMMENTS

Please let us know if you're having issues with commenting.