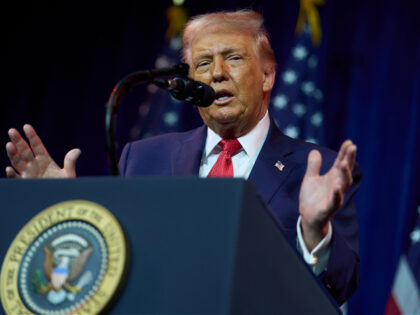

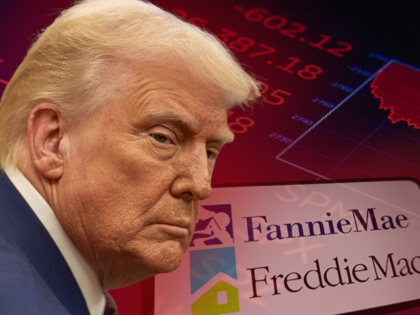

Trump: Fannie, Freddie to Buy $200 Billion of Mortgage Debt to Bring Mortgage Rates Down

President Donald Trump said that having Fannie Mae and Freddie Mac purchase $200 billion in mortgage bonds would drive mortgage rates and monthly payments down as the administration works on affordability.