The Yield Curve Inverts Again, Signaling Agreement with Trump That Rates Are Too High

The bond market and President Trump agree: the Fed should cut rates.

The bond market and President Trump agree: the Fed should cut rates.

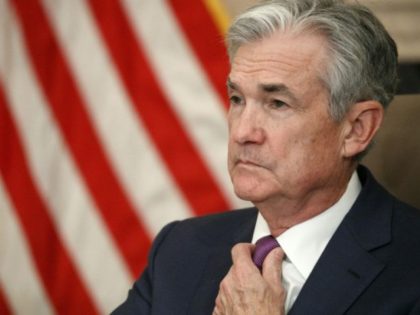

Powell added that the Fed is “very carefully monitoring the situation.”

The Federal Reserve left the target interest rate unchanged at a range of 1.50 to 1.75 percent.

Inflation has been slowing down for the last two months, suggesting that the Fed will not hike rates this year.

Manufacturing and overall industrial output improved, with sharp upticks in autos, business equipment, and consumer goods.

Capital spending and technology spending plans rose in December, suggesting strength ahead for manufacturing

The New York Fed is getting ready for a possible liquidity crunch at the end of the year.

The Federal Reserve on Wednesday left interest rates unchanged and dropped its forecast for a rate hike next year.

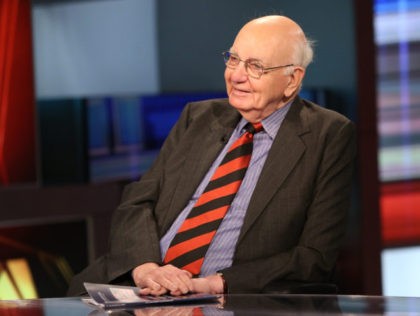

The world’s greatest inflation fighter has died.

Business investment rebounded, easing fears that the manufacturing sector would continue to slowdown into year end.

President Donald Trump on Monday confirmed he met Federal Reserve Chairman Jerome Powell at the White House to discuss monetary policy.

Stocks moved higher despite impeachment inquiry, China trade deal worries, and Fed chair Powell standing pat.

Uncertainty over trade policy is not likely to be the primary cause of depressed business investment in the U.S.

“We should have lower interest rates than Germany, Japan and all others,” Trump tweeted on Thursday morning.

Fed chair Jerome Powell cut rates and promised he would only hike if inflation posed a significant threat.

The Fed delivered the quarter-point cut that the market expected on Wednesday.

The market is all but certain Federal Reserve officials will cut interest rates at the end of their two-day meeting this week. But what comes next is anyone’s guess.

The “temporary liquidity operations” are looking a lot less temporary with each passing day.

The Fed is back in the business of buying Treasury bills again but it really, really doesn’t want you to call it QE.

The Consumer Price Index was flat for September, vindicating Trump’s claim that there is no inflation in the U.S. economy.

The odds implied by futures markets now favor a cut in October and another in December. Even January is now in play.

Currency and rates markets agree with Trump: the Fed’s policy is too tight and rates need to come down.

The market appeared to be on steadier footing on Tuesday, with demand falling to the lowest level in almost two weeks.

The madness was a bit milder on Monday, perhaps indicating that the Fed’s intervention is working to relieve repo stress

No sign of stability in the short-term funding market.

Demand for short-term cash loans for banks is rising and liquidity crunch rolls on.

New home sales were much better than expected in August, putting the year on pace to be the best since 2007.

The short-term funding market still needs emergency liquidty from the Federal Reserve.

The amount of funds needed to keep the short-term repo market under control is still growing and demand is rising.

The Fed’s intervention in the overnight funding market for banks entered its second week on Monday.

The maturity mismatch in coworking spaces could make losses in commercial realestate much worse in a downturn.

The Fed’s life support for the short-term funding market will continue on Friday.

The Federal Reserve Bank of New York once again stepped into the money market to supply additional liquidity on Thursday morning. The N.Y. Fed injected $75 billion into the market for overnight repurchase agreements, known as repos. The Fed had

Here’s everything you need to know about the repo market but were afraid to ask.

Trump described the Fed’s move to cut rates by only one quarter of a percentage point as a failure of vision.

The Fed moved its benchmark short-term rate target to a range between 1.75 percent and 2 percent Wednesday.

The repo market is still throwing a fit and no one knows why.

A breakdown in the overnight funding market that is key to global finance triggered a massive intervention by the N.Y. Fed.

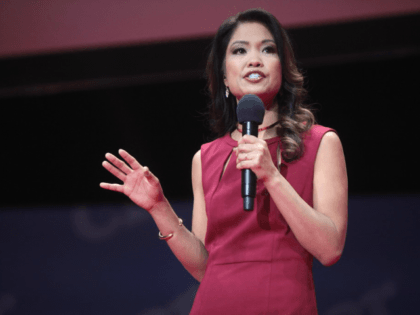

Columnist Michelle Malkin is calling on President Trump to “shut down” a Federal Reserve program that profits off remittances sent to foreign countries by illegal aliens.

Trump says the U.S. is missing out on a once in a lifetime oppoirtunity to borrow cheaply while global rates go negative.