This week we can look forward to a decrease in UK earnings, a forecast increase in Eurozone industrial production and a rise in Spanish CPI inflation.

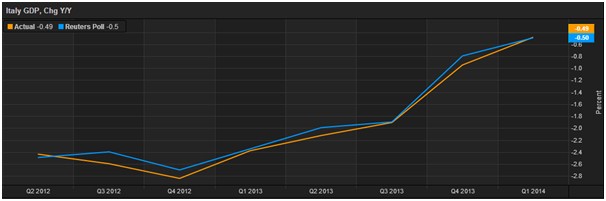

Tuesday 10th June, Italian GDP for Q1 forecast at -0.1 percent and -0.5 percent for the year:

Although this poor showing actually represents an improvement for this heavily indebted economy, the inclusion of ‘black market’ revenues from drugs and prostitution will be included in GDP figures from 2015 and could add 11 percent on to Italian GDP figures with its internationally notorious criminal activity worth an estimated €170bn.

On the downside, European Union contributions are based on the size of a nation’s economy (GDP). Surely Brussels wouldn’t ask a country with a debt load worth 134 percent of its GDP to pay more to the coffers, would they?

Wednesday 11th June, UK average weekly earnings forecast to decline to 1.2 percent.

Meanwhile RPI inflation was running at 2.5 percent recently, implying that real wages continue to decline. Technically, real wages haven’t actually increased since the recession if the RPI measure of inflation is used (which takes account of housing costs).

This isn’t all that surprising given the UK’s reliance on financial services which have been struggling in a new era of increasing regulation and regulatory fines, as well as the fact that Sterling has appreciated considerably holding back the prospects for an uptick in exports.

Thursday 12th June, Eurozone industrial production forecast to increase by 0.9 percent for the year representing a pickup.

The ECB has loosened monetary policy further, and they’ll be hoping this leads to higher levels of lending from banks filtering through to increased production, investment in capital spending and consumer spending.

Friday 13th June, Spain CPI inflation forecast to rise 0.2 percent over the year.

Inflation in Spain is nearing deflationary levels, and Friday’s figures should highlight why the ECB deemed it essential to act to avoid sliding prices that would result in consumers and businesses deferring spending in anticipation of lower future prices.

COMMENTS

Please let us know if you're having issues with commenting.