A recently closed legal migrant route encouraging “high skilled” individuals to come to the UK was “heavily abused” with huge numbers using it potentially lying about their incomes, a review by the Homes Office has found.

Many migrants said their earnings were higher to immigration authorities than to tax authorities, with the highest recorded difference £154,159 and the average £27,600, across all cases looked at.

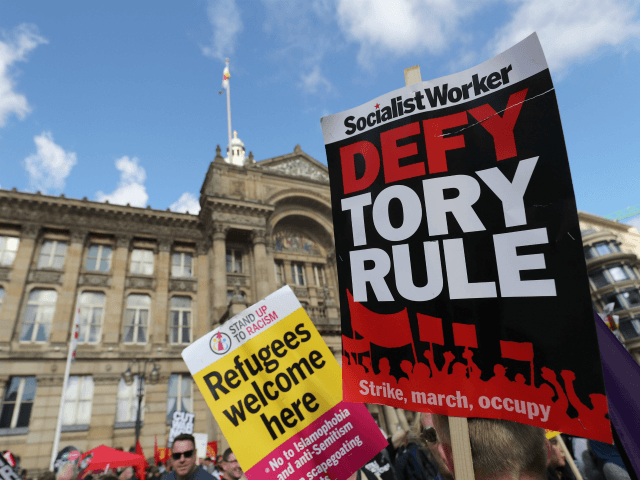

The government has used a “paragraph 322(5)” clause to block applications from those found cheating, prompting six protests backed by Labour and SNP MPs, who linked it to the government’s “hostile environment” policy.

The review, however, found that just 31 people may have been wrongly refused a visa in the crackdown, with more than a thousand potentially cheating.

The damning report comes as the government examines new migration policies for when the UK takes back control of its border after Brexit, with Theresa May promising in October to prioritise skills.

The so-called Tier 1 migration route was announced in 2010 for highly skilled migrants looking to job hunt or become self-employed in the UK.

Points were awarded for good English skills and qualifications and it differed from other categories as a sponsor or employer was not needed.

However, “partly as a result of widespread abuse, the route was closed to new applicants in 2011”. Yet, it remained open to many already in Britain — those extending a stay or applying to settle — with the last cases closed in April of this year.

Our 6th peaceful protest today against #HomeOffice injustice and #HostileEnvironment.#HighlySkilledMigrants#DontForgetAboutUs pic.twitter.com/40jh6Qs8Uj

— HighlySkilledUK (@HighlySkilledUK) November 20, 2018

The review slams Tier 1, saying it did not “deliver as intended”, adding: “The lack of a sponsoring employer or any other form of third-party oversight of migrants’ activities meant that the category was heavily abused.”

Examining 1,697 applications refused since January 2015, the review found Tier 1 applicants typically used their claimed self-employed income to “top up” their earning to meet requirements to enter the UK.

Large differences later showed up between the self-employed earnings shown on the applicant’s initial HMRC tax records and those claimed in the Tier 1 applications given to the Home Office for the same periods.

In a massive 88 per cent of cases, these differences amounted to more than £10,000 and in the majority of cases – 83 per cent were recorded – amendments were made more than three years after the date of the original tax return, potentially to avoid detection.

May’s Post-Brexit Migration Plan Could See Numbers ‘Significantly’ Rise https://t.co/68yuBNakZP

— Breitbart London (@BreitbartLondon) October 2, 2018

The report makes some suggestions as to why this might be, finding evidence suggesting widespread and deliberate cheating of the system, and patterns indicating organised sharing of information on how to avoid detection.

Suspicion was raised and tax authorities began sharing information with immigration authorities in 2016, as “the pattern of behaviour in amending tax records was sufficiently unusual for HMRC to draw it to the Home Office’s attention”.

However, after this, there was a massive rise in people altering their income on their tax documents so it matched that shown on immigration documents, “possibly because it had become widely known” checks were being made.

Furthermore, until mid-2015, only around 5 per cent of Tier 1 applications were refused, consistent with other categories.

After that, they began to increase, rising to 51 per cent refusal in the year ending March 2018, suggesting migrants had learnt the system was open to abuse before authorities began to crack down.

Honourable MPs @Stuart_McDonald, @alisonthewliss, @stephenctimms @RuthCadbury and @Afzal4Gorton #Tier1Community really appreciates your help and support to strengthen our fight against #HomeOffice injustice and #HostileEnvironment!!#HighlySkilledMigrants#DontForgetAboutUs pic.twitter.com/riqkecZ2v9

— HighlySkilledUK (@HighlySkilledUK) November 20, 2018

In the review, the Home Offices also defends using “paragraph 322(5)” for blocking migrant applications — which is also used for national security threats — on those caught presenting false or inaccurate information about earnings.

They used it to block cases “where an applicant’s character and conduct call into question their desirability of remaining in the UK”.

The review adds: “These have not generally been cases of ‘minor tax errors’, as has been presented. The differences between the earnings declared to the Home Office and those shown by their tax records were over £10,000 in 88% of cases looked at.”

Home Office review of 322(5) tax discrepancy cases now published. Accepts mistakes made in small number of cases (c.3%), which are under review. https://t.co/qkyf0tFtny

— Colin Yeo (@ColinYeo1) November 22, 2018

COMMENTS

Please let us know if you're having issues with commenting.