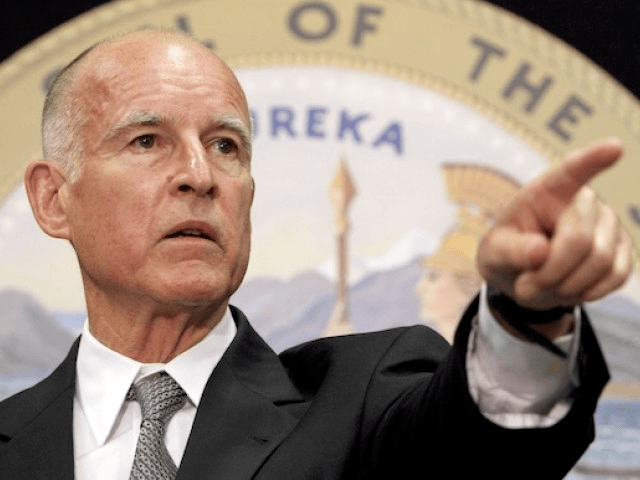

Despite California having the largest manufacturing base in the nation, the state is growing high-paying manufacturing jobs at only one seventh of the U.S. average. The culprit in this debacle is Governor Brown’s wildly expensive alternative energy mandates that stab industrial manufacturers with electrical costs that are about double the U.S. average.

The Boston Consulting Group (BCG) announced last year that the majority of large U.S.-based manufacturers intend to bring back production jobs from China to benefit from rising American labor competitiveness and cheap U.S. industrial energy costs.

BCG, the premier strategic planning advisor to multi-national corporations, was a prime mover in off-shoring U.S. manufacturing jobs to China to benefit from cheap wages after the communist nation opened up to international business in 1993. Each year, BCG surveys its manufacturing executives to gain insight into their preferences regarding manufacturing.

The top three competitiveness factors named by BCG’s customers regarding production locations have been 1) labor costs (cited by 43% of respondents); 2) proximity to customers (35%); and 3) product quality (34%). Over 80% of respondents cited at least one of these 3 issues as a key competitiveness factor, but no customer mentioned the importance of differentiated energy costs for competitiveness.

In a report titled “The U.S. as One of the Developed World’s Lowest-Cost Manufacturers,” BCG found that manufacturing costs in Germany, Japan, France, Italy, and the U.K. were 8 to 18% higher than in the U.S. Besides labor costs (adjusted for productivity), the biggest drivers empowering a U.S. advantage were a 70% costs advantage for electricity and natural gas. BCG predicted that the U.S. could displace up to 5% of total exports from these developed countries in the next five years.

Given that energy is 13% of manufacturing costs versus only 8.5% for labor, BCG found that European energy rates rose by 46% compared to only 16% for the U.S. over the last decade, according to the Energy Information Agency. With electrical rates due to alternative subsidies in Germany at $.38 per kilowatt hour compared to $.12 in the U.S., BCG sees Germany as extremely vulnerable to U.S. manufacturing competiveness.

When BCG conducted a similar manufacturing cost analysis that included China in “The Shifting Economics of Global Manufacturing,” it found the average manufacturing wage (adjusted for inflation) in China has more than tripled in the last decade versus only a 27% increase in the U.S. But the biggest competitive difference is that natural gas prices are 360% higher in China than the U.S.

All of this should have caused a manufacturing jobs boom in California, but that has not happened. Since February 2010, U.S. manufacturing jobs, which pay about 8.4% more than all other industries combined, have increased nationally by 6.7%, versus only 1% in California. In low-tax and low-regulation states like Indiana and South Carolina, the growth has been 15% or more.

To subsidize the Brown Administration’s massive commitment to solar and wind alternative energy sources that cost about five times more than natural gas, California spiked industrial rates. The Brown-dominated California Public Utility Commission sets electrical rates on low volume residential users at about $.13 per kilowatt hour, less than 10% higher than the national average at $.12. But to pay for alternative subsidies, the PUC sets rates on very high volume industrial users at over $.13 per kilowatt hour, versus less than $.07 for the rest of the U.S.

BCG’s latest survey of more than 200 decision makers at companies across a broad range of industries found that 54% of U.S. manufacturing executives are now planning to “re-shore” production back to the U.S. About half of those respondents said they are “actively doing this” or that they “will move production to the U.S. in the next two years.”

Despite this surge in enthusiasm to bring back manufacturing jobs that pay an average $19.80 an hour to the U.S., BCG will counsel its clients to stay away from California to avoid being stuck with the bill for Jerry Brown’s alternative energy subsidies.

If you are interested in the economic pain suffered by the California middle class, please click on California Might be 7th Largest Economy, But is 1st in Poverty

COMMENTS

Please let us know if you're having issues with commenting.