The summer of 2022 is poised to deliver a dangerous challenge to overstressed power grids around the world, at a time of soaring energy prices and reduced fuel inventories thanks to the coronavirus pandemic aftermath and Russia’s invasion of Ukraine.

Bloomberg News on Monday contended the global power crunch is already well underway:

Asia’s heatwave has caused hours-long daily blackouts, putting more than 1 billion people at risk across Pakistan, Myanmar, Sri Lanka and India, with little relief in sight. Six Texas power plants failed earlier this month as the summer heat just began to arrive, offering a preview of what’s to come. At least a dozen US states from California to the Great Lakes are at risk of electricity outages this summer. Power supplies will be tight in China and Japan. South Africa is poised for a record year of power cuts. And Europe is in a precarious position that’s held up by Russia – if Moscow cuts off natural gas to the region, that could trigger rolling outages in some countries.

“War and sanctions are disrupting supply and demand, and that’s coupled with extreme weather and an economic rebound from Covid boosting power demand,” said Shantanu Jaiswal, a BloombergNEF analyst. “The confluence of so many factors is quite unique. I can’t recall the last time they all happened together.”

…

In India, power shortages in many states are already nearing levels from 2014, when they were estimated to have shaved about 5% off the country’s gross domestic product. That would mean a reduction of almost $100 billion should the outages become more widespread and last through the year. A run on electricity would also likely contribute to more gains for power and fuel markets, raising utility bills and further fanning inflation. When plants on the Texas power grid failed this month, wholesale power prices in Houston briefly jumped above the $5,000 a megawatt-hour price cap, surging 22 times higher than the average cost of on-peak power that had been secured for the day.

This Tuesday, Feb. 16, 2021 file photo shows power lines in Houston, Texas. (AP Photo/David J. Phillip)

The U.S. and Canada are not immune to the crisis, as natural gas supplies are already growing tight across North America. Industry analysts blamed the coronavirus pandemic for maintenance delays that might leave energy infrastructure frail and vulnerable to severe weather.

The Midcontinent Independent System Operator (MISO), a grid that serves 15 states with a combined population of over 42 million people, warned it has “insufficient” power generation capacity to meet high summer demand — the first time MISO has ever issued such a warning. Customers in 11 MISO states were told they could face power outages.

Heavy plumes of smoke billow from the Dixie fire above the Plumas National Forest near the Pacific Gas and Electric Rock Creek Power House last July. (Peter DaSilva/UPI)

“The U.S. is experiencing more outages globally than any other industrialized nation. About 70% of our grid is nearing end of life,” CoBank ACB economist Teri Viswanath told Bloomberg News.

The Hindustan Times on Tuesday reported power outages in Delhi due to heavy rain and strong wind. Power company officials said some of the outages were imposed deliberately as a safety measure, while others were caused by storm damage to electrical lines.

A woman walks with a power plant in the background, in Vinnytsia, Ukraine, March 16, 2022. (AP Photo/Rodrigo Abd)

Bloomberg’s report blamed “climate change” several times for increasing energy demand — without providing any evidence to back up the claim — while tiptoeing very carefully around the problems caused by dependence on unreliable “green energy” sources.

Fox News was far blunter on Tuesday, quoting Michigan electrical grid operators who warned their customers that a hasty transition to wind and solar power could lead to shortfalls over the summer. Not only are these renewable energy sources vulnerable to the elements, but the rest of the aging power grid has some compatibility issues with wind and solar farms.

Farmland is seen with solar panels from Cypress Creek Renewables, October 28, 2021, in Thurmont, Maryland. (AP Photo/Julio Cortez)

The World Energy Council said last week that an unprecedented “global energy shock” has been triggered by Russia’s invasion of Ukraine, which caused oil prices to spike and supply chains to fracture.

Unlike previous energy shocks in the 1970s, this one is coming hard on the heels of the Wuhan coronavirus pandemic, which left hollowed-out economies tottering across the developing world. The World Energy Council noted that rising energy prices will feed into inflation spirals, making food and other vital goods increasingly unaffordable. In parts of the Third World, summer blackouts will be made even more dangerous by food and medicine crises.

Wind turbines turn behind a solar farm in Rapshagen, Germany, Thursday, Oct. 28, 2021. (AP Photo/Michael Sohn)

A glimpse of that unpleasant future is provided by Sri Lanka, which is suffering from fuel shortages, blackouts, and a burgeoning food crisis, in part because the pandemic and Russia’s invasion of Ukraine dealt body blows to an economy that had already been eaten alive by irresponsible government spending, debt, and corruption.

Skyrocketing fuel prices and shortages are literally killing Sri Lankans as the island grinds to a halt. Price hikes imposed this week to help balance the government’s books took fuel costs to an all-time high, threatening to make inflation even worse as the prices of almost all goods and services soar.

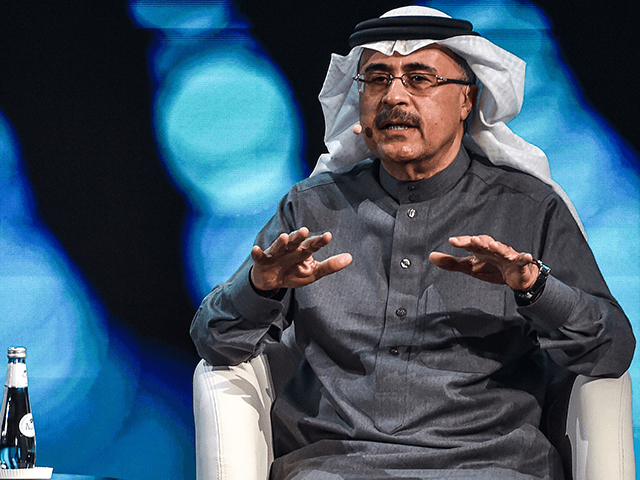

Amin Nasser, the CEO of Saudi Arabia’s national oil company Aramco, introduced another grim portent on Tuesday by noting that certain energy-hungry sectors of the global economy are just beginning to rebound from the pandemic — notably including the aviation industry, which is still about 2.5 million barrels per day below its average fuel consumption before Chinese coronavirus struck.

Nasser further argued that oil companies are not well-positioned to increase their production and refining capacity to meet soaring demand, because the transition to green energy made them reluctant to invest in long-term fossil fuel projects.

“The pressure and the rhetoric is, ‘don’t invest, you will have stranded assets.’ It makes difficult for CEOs to make investments,” he explained.

Amin Nasser, president and chief executive officer of Saudi Aramco, speaks at Riyadh’s Ritz-Carlton hotel on January 27, 2021. (FAYEZ NURELDINE/AFP via Getty Images)

The Biden administration’s risible “climate envoy,” John Kerry, urged the World Economic Forum (WEF) in Davos, Switzerland, not to meet soaring demand by developing more reliable energy assets — an attitude that would guarantee the Saudi Aramco CEO’s prophecy of an unprecedented and unmanageable energy shock comes to pass.

“We cannot be seduced into believing that this suddenly is an open door to going back and doing what we were doing which created the crisis in the first place,” Kerry insisted, secure in the knowledge that he personally will not be facing any blackouts, suffering from any travel restrictions, or dying from heatstroke because his air conditioning stops working over the summer.

U.S. Special Presidential Envoy for Climate John Kerry delivers a speech on stage during for a meeting, as part of the World Leaders’ Summit of the COP26 UN Climate Change Conference in Glasgow, Scotland, on November 2, 2021. (BRENDAN SMIALOWSKI/AFP via Getty Images)

Another energy bomb about to detonate can be found in China, which will soon begin emerging from its latest round of draconian coronavirus lockdowns, with a corresponding surge in demand for industrial energy and transportation fuel.

S&P Global Vice Chairman Daniel Yergin said on Tuesday that if China’s economy rebounds strongly from the lockdowns, with increases in consumer demand and manufacturing, “that’s going to really increase global oil demand and put more pressure on the market.”

“That would actually increase the problems for the world economy and certainly would add to this inflationary problem that the world is struggling with right now,” Yergin said.

“The one thing that would push down price would be a recession, which no one wants,” he added unhappily.

At a WEF panel discussion in Davos on Tuesday, Yergin said the looming global energy crisis is so formidable that the “amnesia about energy security has been put aside” – in other words, grandiose plans for forced transitions to diminished green economies are being moved to the back burner as frightened populations demand more access to proven energy sources.

Yergin’s panel noted that some of this renewed interest in energy security is a result of China ostentatiously shoveling mountains of coal and buying up all the petroleum assets it can get, without the slightest care for the concerns of the climate change movement.

The rest of the world is noticing that Beijing is not willing to risk its industrial might on power outages caused by transitioning to wind and solar power. A global energy crisis with a hefty body count this summer, while inflation soars and standards of living collapse across the Western world, will probably sharpen that interest even further.

COMMENTS

Please let us know if you're having issues with commenting.