With promises of tax cuts flying around Washington these days, the big question is: do you believe in sugar plum fairies?

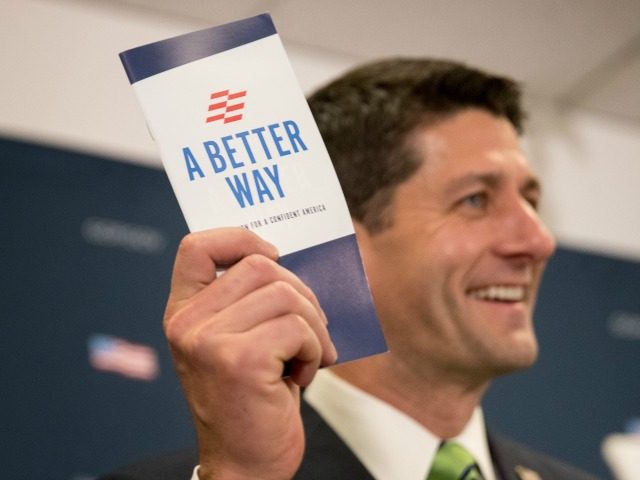

Speaker of the House Paul Ryan’s controversial Border Adjustment Tax plan will raise $1.2 trillion over ten years by imposing taxes on imports, but he promises that dollar appreciation will pay for everything. Importers like my family’s educational toy company are crying foul.

Ryan’s plan is based on the theory that under the BAT plan the dollar will immediately appreciate by 25%. You read that right – Paul Ryan is betting the federal tax system on a market prediction.

Would you bet the nest egg on a single stock or a horse in the fifth race at Belmont? That’s what Ryan has in mind for us. Even economists admit that exchange rates follow a random walk.

Backers of the plan say that importers will leverage the rising U.S. dollar for cost reductions sufficient to pay the new taxes. In our case, the new tax bill will be a staggering 165% of earnings. I wish I were kidding. We will need a lot of cost reductions to cover that nut.

Is a more valuable dollar a good thing? We should be careful of what we wish for. The dollar appreciates because of shifting supply-and-demand as imports fall and exports rise. Of course, a skyrocketing U.S. dollar will also make it much harder to sell U.S. goods overseas. Today, after a recent run-up in value, the dollar is already a problem for U.S. exports. A further 25% bump may put a big dent in U.S. exports. That doesn’t sound like good times to me.

Importers say that savings from a rising dollar won’t materialize. A careful analysis suggests that importers may know what they’re talking about.

American importers typically buy in U.S. dollars, not foreign currency. Since 97% of importers are small businesses, this approach keeps things simple and eliminates the need to hedge with sophisticated financial instruments. Small businesses don’t have forex departments. To capture possible savings, importers will have to renegotiate each contract on each item with each factory. That’s a huge undertaking. Importers insist their factories will not easily grant concessions

The problem gets worse. Trade goes in both directions in the global economy. Almost all goods incorporate components (costs) that are directly or indirectly imported. When the dollar jumps by 25%, imported content also rises in cost by the same percentage. This increase offsets savings from reduced local content costs.

There are many such examples. Foreign-made apparel often use U.S.-spun yarn made from U.S. cotton. Toys may include imported wood, plastic and paper. Even the drive from factory to port is in a truck with imported parts powered by imported gasoline. In our industry, factories claim that foreign content ranges from 30% to 65%. This implies that our factories’ cost changes will range from a 6.5% reduction to a 9.25% increase. On average, we actually expect our costs to rise under the BAT plan.

If we are right, those costs will be passed on to you, the consumer. Where else can they go? Facing a 165% tax bill and rising costs, we will have to choose between imposing huge price increases or going bust. Not a pleasant thought.

None of this is necessary. Congress can choose to reduce rates in combination with spending reductions to balance the budget. Going on a diet is probably just what the doctor ordered for the Federal government anyhow. Perhaps with a smaller budget, Congress won’t have the time or resources to dream up dangerous plans like the BAT in the future.

Rick Woldenberg is CEO of Learning Resources, an educational toy company based in Vernon Hills, Illinois. Learning Resources was founded in 1984 and employs 150 people in the U.S. and overseas. Rick’s blog can be found at www.BorderAdjustmentTax.com.

COMMENTS

Please let us know if you're having issues with commenting.