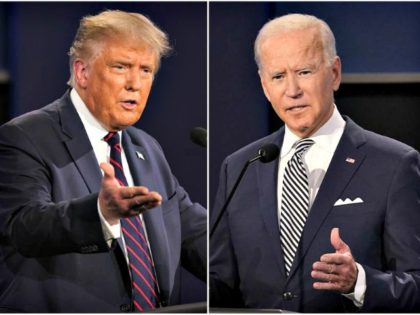

Trump Savings Plan for Working Americans a Smash Hit with Swing Voters

President Donald Trump’s proposal to give Americans without access to a workplace retirement plan an option to invest in a federal-style alternative similar to the Thrift Savings Plan is a smash hit, according to focus groups conducted by the Sentinel Action Fund.