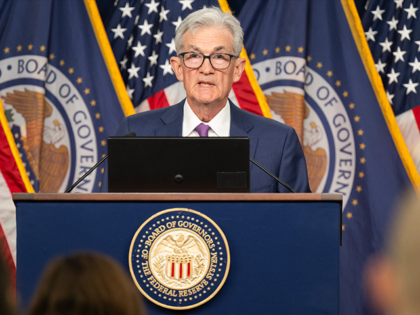

Stephen Moore: Cutting Government Spending Is Key to Lowering Interest Rates, Not the Fed

On Friday’s broadcast of Newsmax TV’s “Carl Higbie Frontline,” former Trump Economic Adviser Stephen Moore said that he wants to see lower interest rates, but getting that primarily depends on cutting government spending, not actions from the Federal Reserve. Moore said,