Trump’s Truth Social Responds to Attack from Citadel Securities: ‘World Famous for Screwing Over Everyday Retail Investors’

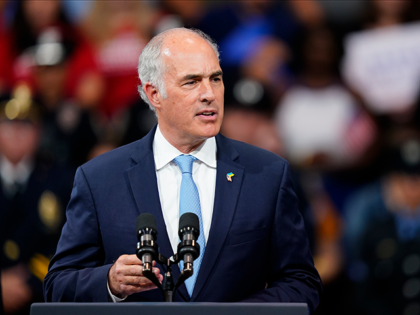

Former President Donald Trump’s social media platform, Truth Social, issued a statement after Florida-based marketing firm Citadel Securities slammed Trump Media CEO Devin Nunes as being a “proverbial loser.”