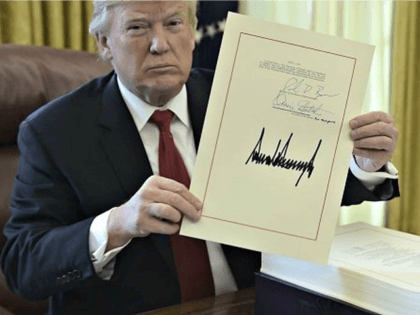

Trump Cut Taxes on Most Americans but Hardly Anyone Believes It

81% of middle-income households got a tax cut but many people mistakenly think they got tax hikes.|

81% of middle-income households got a tax cut but many people mistakenly think they got tax hikes.|

Hillary Clinton warned of “real national emergencies” that included “Americans dying for lack of health care,” despite Obamacare remaining in place.

Note what Cuomo is not talking about: fixing the problem, which would require lowering his state’s taxes, most especially New York’s obnoxiously high 8.82 percent income tax rate

Democrats looking to score points against President Trump this week focused attention on data from the government that showed refund checks going out to early filers were smaller than they were a year ago.

Republicans clapped and rose to their feet in a standing ovation as they chanted “USA” while Democrats sat quiet when President Donald Trump called the state of America “strong” during Tuesday’s State of the Union address.

Multinational conglomerate AT&T is continuing to layoff American workers across the United States after raking in billions in additional profits from the 2017 Tax Cuts and Jobs Act.

Democrats, media figures, and pundits predicted over the last two years that many people would die as a result of President Donald Trump’s policies.

Corporations are infusing money back to the U.S. from abroad in record numbers for the third quarter since passage of the Tax Cuts and Jobs Act to the tune of $92.7 billion dollars.

Democrat candidate Sean Casten spoke during an interview on Sunday about President Trump’s tax cuts, calling for them to be “completely eliminated.”

President Donald Trump and Congressional Republicans have expanded health care options and lowered health insurance premiums while protecting patients with pre-existing conditions, contrary to Democrats’ narrative.

Elaine Parker of Job Creators Network writes for RealClear Politics that Americans are misinformed about the Tax Cuts and Jobs Act, so her organization is undertaking to educate them about economic policies and how they impact middle class families:

A new poll released on Monday shows that Rep. Kevin Cramer (R-ND) has jumped to a ten point lead over incumbent Sen. Heidi Heitkamp (D-ND) in the North Dakota Senate race.

The Congressional Leadership Fund (CLF continues to lead the charge to deploy the Republican grassroots to defy history and hold the House Republican majority.

Job Creators Network presented Rep. Marsha Blackburn (R-TN-07) with its Defender of Small Business Award on Wednesday in Franklin, Tennessee for the key role she played in the passage of President Trump’s Tax Cuts and Jobs Act.

Sen. Heidi Heitkamp (D-ND) is up for re-election this November in a state President Donald Trump won by 36 points in 2016.

Rep. Tom MacArthur (R-NJ) said he wants “strong, secure borders,” while his Democrat opponent Andy Kim wants to impeach President Donald Trump, abolish ICE, and create open borders.

President Donald Trump chided Sens. Jon Tester and John McCain for voting against Obamacare repeal at a rally in Montana on Thursday night.

President Donald Trump touted the benefits of the Tax Cuts and Jobs law and welcomed American beneficiaries of it to share their personal stories during a Friday celebration of the law’s six month anniversary.

Workers in two American industries that many economists had consigned to the dustbin of history saw some of the biggest gains in wages, bonuses, and benefits in the start of 2018.

American manufacturing sentiment has reached a 20-year high, according to a new survey released by the National Association of Manufacturers (NAM).

A new report finds that electric, gas, and water rates have fallen across the country due to the tax cuts put in place by President Donald Trump and the GOP.

Retiring Senator Orrin Hatch (R-UT) gave another endorsement of his chosen successor, former Massachusetts Governor Mitt Romney, in his Thursday address at the Faith and Freedom Coalition’s “Road to Majority” conference on Capitol Hill.

Costco announced on Thursday it will raise its minimum wage for hourly workers, thanks to President Donald J. Trump’s tax cut legislation.

A study from the University of Wisconsin-Madison released this week revealed that President Donald Trump’s Tax Cuts and Jobs Act led to an increase in defined-benefit pension plans in 2017.

Rick Santorum said he will soon unveil a new Obamacare block-grant repeal proposal that will both lower premiums and increase the number of insured.

McDonald’s announced Wednesday it would triple the amount of funding allocated to its employee tuition-assistance program due to the GOP tax reform bill signed into law last year.

Nancy Pelosi (D-CA) backtracked on her “crumbs” comment about tax reform, admitting that “we are thankful whenever workers get bonuses.”

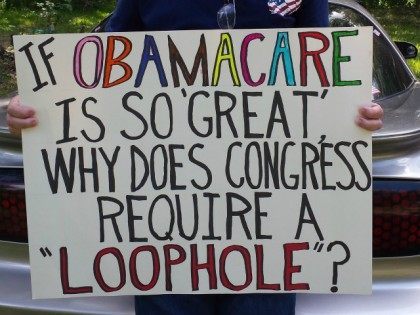

A new poll conducted by the Kaiser Family Foundation reveals that nearly four in five Republicans oppose Obamacare.

American manufacturing expanded at the fastest rate since May 2004, according to the Institute for Supply Management (ISM).

House Minority Leader Nancy Pelosi (D-CA) called the Tax Cuts and Jobs Act “unpatriotic” at a town hall in Arizona on Tuesday.

A new poll conducted by SurveyMonkey revealed that a majority of Americans support President Donald Trump’s tax reform law.

Small-business confidence has reached new heights in 2018 after President Donald Trump signed the Tax Cuts and Jobs Act.

Rep. Todd Rokita (R-IN) unveiled the CRUMBS Act, exempting bonuses received thanks to tax reform and mocking House Minority Leader Nancy Pelosi (D-CA) for saying these bonuses amounted to “crumbs.”

MetLife announced on Monday they will institute a $15 minimum wage as well as a $10 million in investment in their workers due to tax reform.

Lt. Governor Gavin Newsom seems to be trying to rescue his collapsing Governor campaign by leveraging his Chairmanship of the California Lands Commission to fight the Trump administration’s plan to open up offshore oil drilling. One of the positions that

Chipotle announced on Wednesday that they will give their employees bonuses up to $1,000 and other worker-related benefits thanks to tax reform.

The United States Treasury Department revealed new estimates last week that show the country set to double borrowing in the current fiscal year, a total $995 billion that would nearly double last fiscal year’s $519 billion.

Maryland Attorney General Brian Frosh revealed on Thursday that he plans to sue President Donald Trump over the recently passed Tax Cuts and Jobs Act.

UPS, Cigna, and Hostess announced massive bonuses and investments on Thursday thanks to the recently passed Tax Cuts and Jobs Act.

Lowe’s confirmed on Thursday that it plans to give its workers bonuses of up to $1,000 as a result of tax reform.