Corporate greed. Vladimir Putin. Supply chains. Shortages. Re-opening growing pains. Consumers switching to goods from services.

These have all been offered as explanations for the very high inflation that has gripped the country since last year. A new study from researchers at the Federal Reserve Bank of New York, the University of Maryland, and Harvard University finds that the biggest driver has been something far simpler: excessive consumer demand.

In a post at the New York Fed’s blog, economist Julian di Giovanni summarized a recent paper that investigated the source of inflation. The paper found that a general rise in consumer demand was responsible for roughly 60 percent of the inflation in the U.S. between 2019 and 2021.

Supply shocks accounted for forty percent of inflation, the paper found. Changing patterns of consumer spending played almost no role.

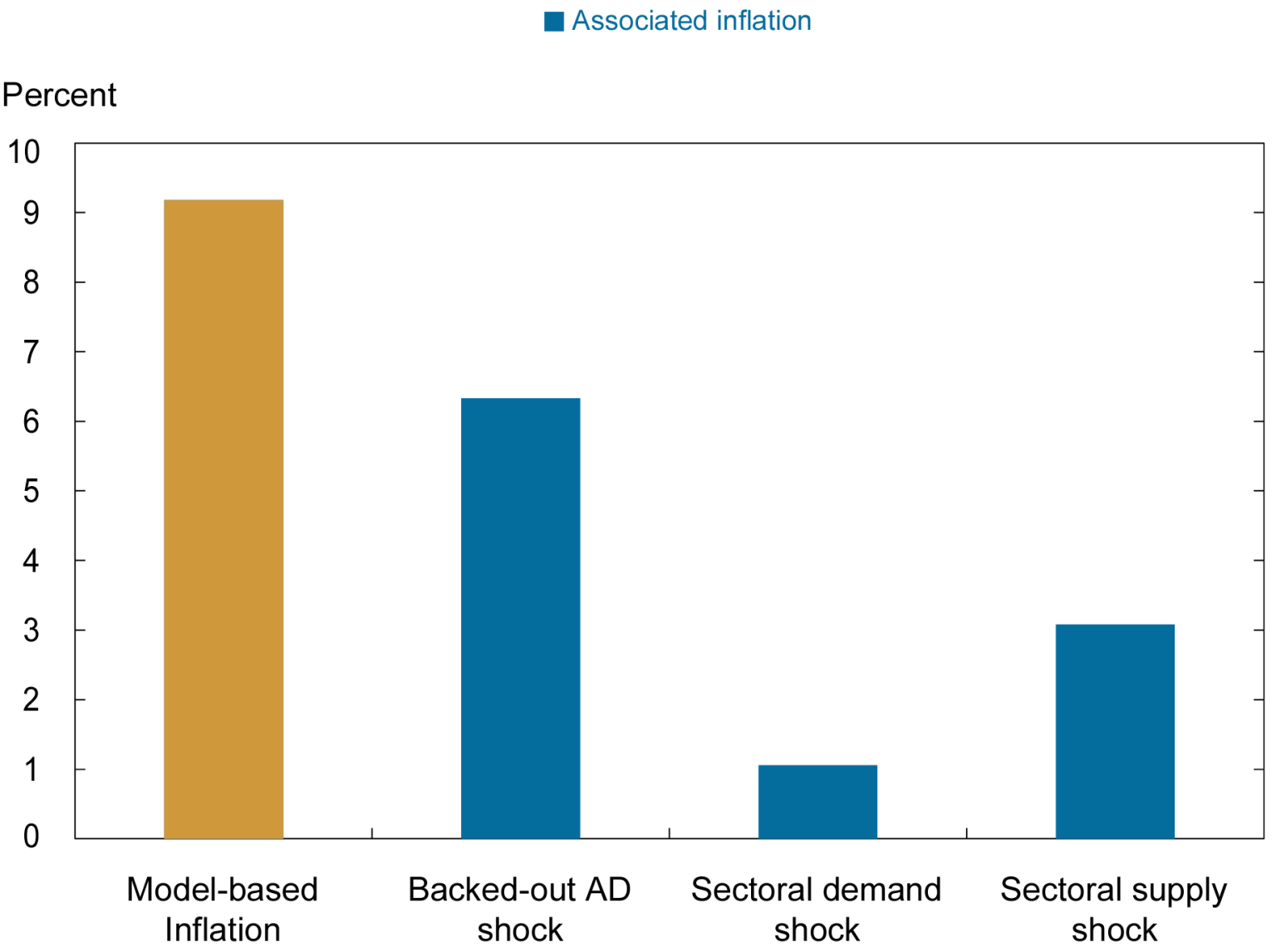

In this chart, “backed-out AD shock” represents the share of inflation caused by increased spending, “sectoral demand shock” represents the share arising from consumers shifting patterns of spending, and “sectoral supply shock” represents the share rooted in shortages, supply chain snarls, and the like.

Source: di Giovanni, Kalemli-Özcan, Silva, and Yildirim (2022). Notes: The chart presents a U.S. closed-economy inflation decomposition for a sixty-six sector economy, 2019-21. The first bar shows model-based inflation considering all shocks (demand and supply). The second bar considers the aggregate demand shift only. The third bar uses sectoral demand shocks only. Finally, the fourth bar uses sectoral supply shocks only.

The source of inflation has been a contentious issue. Critics of the Biden administration’s $1.9 trillion 2021 stimulus package have said it pumped too much demand into the economy, fueling inflation. The Biden administration has frequently insisted that demand played a minor role and pointed the finger at supply shocks.

The belief that inflation was rooted in supply shocks also helped mislead many into thinking inflation would be transitory.

The debate has also played a role in assessing the appropriateness of monetary policy. Those who think supply shocks played a much more bigger role than demand have often argued that the Fed should not raise rates to fight inflation because that will do little to create more supply—and could hurt investment, making supply issues worse.

The researchers found that even if there had been no supply shocks, inflation in the United States would have been around 6 percent at the end of 2021 instead of 9 percent.

“While our model-based calibrations imply that a contraction in aggregate demand will help dampen inflation, there will remain upward pressure on price growth as long as global supply bottlenecks persist,” the paper finds.

COMMENTS

Please let us know if you're having issues with commenting.