The Fed’s Inflation Confidence Game

When Federal Reserve officials met last month, they told us they needed “greater confidence” that inflation is moving “sustainably” down to two percent before they start reducing interest rates.

It would be an understatement to say that the inflation data released on Thursday are unlikely to produce an increase in that confidence. Inflation is rising, and the underlying indicators of price pressures suggest this is unlikely to reverse soon.

The Department of Commerce released its report on personal income and expenditures on Thursday. This includes the latest calculation of the personal consumption expenditure (PCE) price index, which is the measure the Federal Reserve uses in its two percent target and in the forecasts that get published every other meeting in the summary of economic projections.

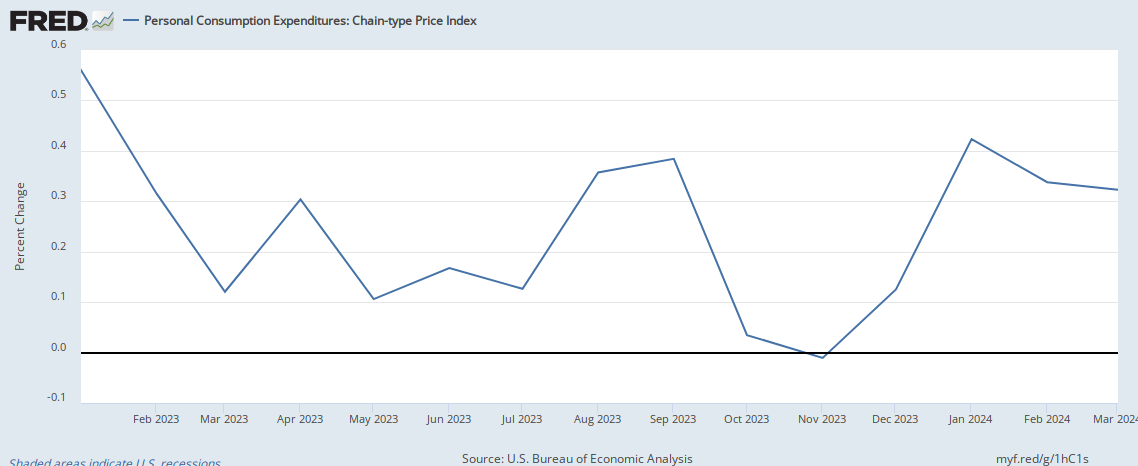

The PCE price index rose by 0.3 percent in January, an annualized inflation rate of 4.2 percent. Core PCE inflation, which excludes food and energy, rose by 0.4 percent, which annualizes to a 5.1 percent inflation rate. Both measures show an acceleration of inflation from a month earlier.

Headline PCE inflation rose at its fastest clip since September of last year and has been climbing for two straight months.

The core index has also been climbing for two straight months and rose at its fastest rate since January of last year.

There was some ongoing softening in the year-over-year metrics, but that’s merely a reflection of the base effects. Very high month-to-month numbers from 2022 and 2023 are dropping out of the 12-month calculation, so the year-over-year number comes in lower.

Heightened Expectations

Wall Street was expecting a rise in inflation after the hotter-than-expected consumer price and producer price indexes, so the results did not come as a shock. But it is useful to keep in mind that this is not what analysts were expecting before we got the other January inflation reports.

Interestingly, the wedge between CPI and PCE inflation vanished in January. Before rounding, core CPI actually came in a bit hotter than core PCE this month.

There’s a lot beneath these numbers that is likely to worry Fed officials.

Durable Goods Prices Rising Again

Let’s start with goods inflation. At his press conference in January, Federal Reserve Chairman Jerome Powell pointed out that a lot of last year’s disinflation came from actual deflation in the prices of goods. While this was welcome—the Fed had actually expected this to occur much earlier, and its delay was one of the reasons the “transitory” forecast turned out to be so wrong—it is unlikely to last.

“We have six months of good inflation [readings]. But you can—and you know this—you can look behind those numbers, and you can see that a lot of it’s been coming from goods inflation, for example, and goods inflation running significantly negative,” Powell said. “It’s a reasonable assumption that, over time, goods inflation will flatten out—probably approximate zero. That would mean the services sectors would have to contribute more.”

Traders work on the floor of the New York Stock Exchange during morning trading on February 29, 2024, in New York City. Stocks opened up on the rise as investors await the latest release of inflation data from the Personal Consumption Expenditures (PCE) index. Michael M. Santiago/Getty Images)

The January PCE numbers show that not only did goods disinflation flatten out, it partially reversed. Overall goods prices kept falling, with the index dropping by 0.2 percent, dragged down by a 0.4 percent decline in nondurables. But durable goods prices actually rose for the first time since May, climbing 0.2 percent.

This has two implications. First, if the nondurable goods deflation had not continued in January, overall inflation would have been even higher. That matters because nondurable goods deflation is not likely to continue. It is likely to become a source of positive inflation if energy prices climb as a result of global geopolitical tensions or due to a recovery in demand when European and Asian economies get back on their feet.

Second, the rise in durable goods prices may signal that the end of deflation for that category is here. And the fact that higher durable goods prices did not hold back services inflation is worrisome.

At Your Service

Services inflation soared 0.6 percent, the fastest rate since January of last year. The category that so many Fed officials have said they watch closely, services excluding housing and energy, also rose 0.6 percent. To put that in perspective, that’s the equivalent of a 7.4 percent annual rate of inflation.

While the January figures are unlikely to shatter the Fed’s confidence that inflation is coming down to two percent, they cannot plausibly have led to “greater confidence.” This means that the coming reports on February inflation—CPI will be out on March 12—will be all the more important.

COMMENTS

Please let us know if you're having issues with commenting.