In our weekly preview of the financial markets we look at US home sales, the growth of the EU money supply, Eurozone inflation and unemployment, and rising UK house prices.

Monday 28th April, US Pending home sales forecast to rise by 1.5 percent in March (due 15:00 GMT):

The Pending Home Sales survey is a large national survey, typically accounting for about 20 percent of transactions for existing-home sales. Forecasts for April are somewhat mixed, although the Reuters poll forecasts a small tick up in the index this time round.

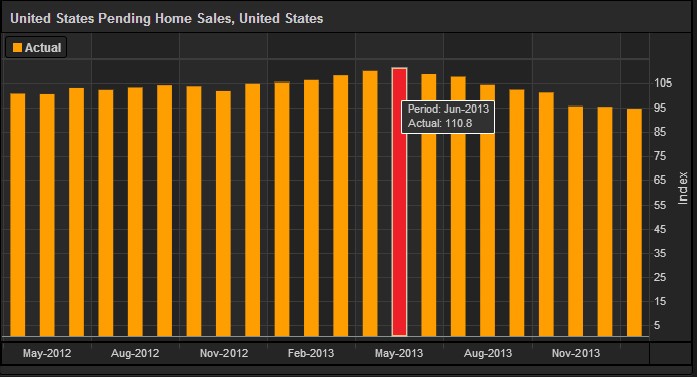

That said, the index has been in decline since the interest rate on a 30 years mortgage spiked up from around 3.25 percent to 4.27 percent. See the below graphs to see the correlation. Given just how sensitive house purchases are to rate rises, it’s understandable that the Federal Reserve is constantly shifting the goalposts for when they will even consider raising interest rates as they attempt to kick the can ever further down the road

Above: Interest rates rise in June, coinciding with Ben Bernanke’s road map to withdraw the Federal Reserve’s monetary stimulus.

Above: Following the rise in rates, pending home sales begin to decline, underscoring just how sensitive the market is to any movement in interest rates.

Tuesday 29th April, Eurozone M3* annual growth forecast at 1.4 percent (due 9AM GMT):

With growth of the money supply in the Eurozone still scraping along the bottom, it should come as little surprise that loans to the private sector are forecast to decline once again at a rate of 2.1 percent (declining 2.17 percent previously). This is well below is pre crisis trend of 4-8 percent growth in the money supply as measured by M3.

In reality, the measure of M3 growth and loan growth are both interconnected. For so long as loans are being repaid, the rate of M3 growth will be minimal and as such, we should expect to see a period of low inflation and potentially appreciation of the Euro (until low M3 growth prompts action from the ECB at least).

With UK M3 growth at similarly low levels in spite of the Bank of England’s Quantitative Easing and Funding for Lending, it really does begin to raise the question of just how much central banks can actually do to affect the broad supply of money.

Also, UK GDP growth for Q1 is due (9:30GMT) and is forecast to show an annualised rise of 3.2 percent as the UK economy continues to grow at a fast pace, underpinned by a property boom that is driving consumer credit growth and a range of residual activity that goes with the purchase of property.

*M3 is the broadest measure of the money supply. It includes a range of assets held by financial institutions in addition to cash and deposits.

Wednesday 30th April, Eurozone inflation figures expected to show a slight pickup rising by 0.8 percent on an annualised basis, up from 0.5 percent previously (10:00GMT).

With the European Central Bank head, Mario Draghi, having asserted that it was his belief inflation would begin to pick up in April, the credibility of the Eurozone’s Central Bank rests on such an increase being realised.

Another slow down would indicate a continuation of the move towards deflation and would surely force the ECB’s hand in enacting another loosening of monetary policy at their rate setting meeting on May 8th.

Expect the Euro to drop lower against major currencies if inflation does fall shy of the 0.8 percent forecast on expectation as traders position themselves in preparation for either QE in the Eurozone or another rate cut on May 8th at the rate setting meeting.

Also, US GDP figures for Q1 are expected to show that the US economy expanded at its slowest pace in a year, recording growth of 1.2 percent. The Federal Reserve will also have their Open Market Committee Meeting, with tapering expected to continue.

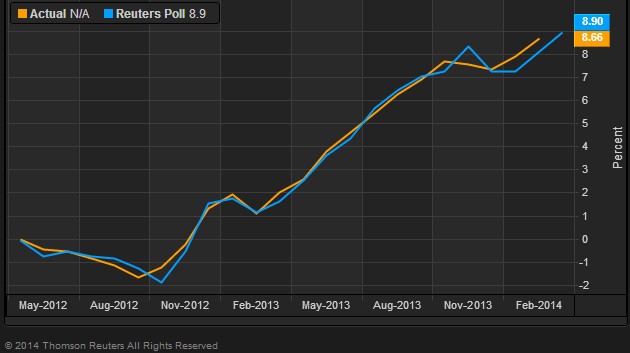

Thursday 1st May, UK House Prices forecast to rise of 8.9 percent

Above: UK property prices as measured by Halifax.

The latest data from one of the UK’s largest mortgage lenders, Halifax, should confirm that house prices continue to increase rapidly at an annualised rate of 8.9 percent.

House prices have been boosted in part by a boom in London property prices where prices have risen by 29.5 percent in a year. Underpinning this price growth is a shortage of supply particularly in London, low interest rates, and government intervention in the form of Help to Buy (not too dissimilar in its aims and objectives to Freddie Mac and Fannie May).

These factors have combined to boost confidence in the market as people clamour bundle in to property in a desperate bid to avoid being left behind as prices motor ahead. Furthermore, the rise has continued despite Bank of England Governor Mark Carney warning that he is concerned about the potential for a property bubble to inflate in the UK.

Friday 2nd May, Eurozone unemployment forecast to remain at 11.9 percent:

Make no mistake – for all the talk of recovery in the Eurozone, Euro-sclerosis is still a reality for many with unemployment remaining stubbornly high. There is still some way to go until it generates enough growth to dent this significantly, and this year’s forecast GDP growth of 1.2 percent doesn’t appear overly promising.

What’s more, the recovery continues to be lopsided with Italy only forecast to grow by 0.6 percent with its debt levels reach an eye watering 133.7 percent of GDP and unemployment in Greece (26 percent), Spain (25.7 percent), Portugal (16.8 percent) and Cyprus (19.2 percent) remaining uncomfortably high.

COMMENTS

Please let us know if you're having issues with commenting.