Breitbart Business Digest: Treasury Secretary vs. The Regulatory Woketopus

This is the Breitbart Business Digest weekly wrap, in which we coincidentally run through the economic and financial news of the previous seven days.

This is the Breitbart Business Digest weekly wrap, in which we coincidentally run through the economic and financial news of the previous seven days.

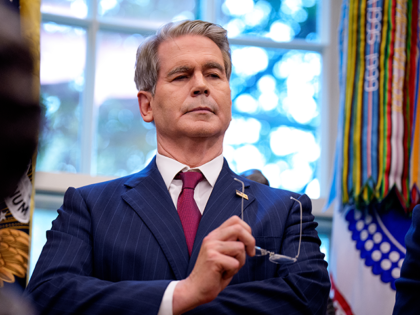

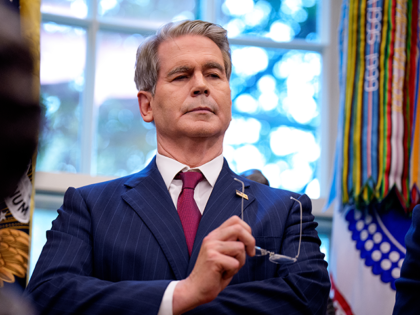

Sen. Bill Hagerty (R-TN) discusses his bipartisan legislation to shore up main street’s community banks and credit unions.

Federal regulators have issued Wells Fargo formal orders demanding they get better at catching customers who misuse their services for criminal acts, as the bank faces a lawsuit alleging they allowed a $460 million Ponzi scheme to operate.

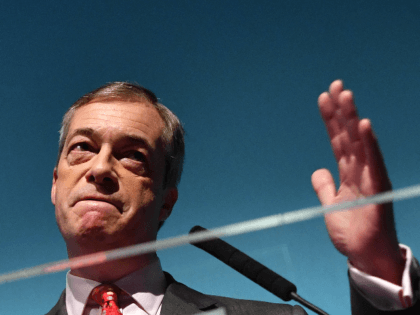

The NatWest banking group has announced that Sir Howard Davies will be replaced in the wake of the Nigel Farage debanking scandal.

A watchdog has demanded that UK banks reveal the number of accounts closed over politics in the wake of the Nigel Farage debanking scandal.

The Bank Panic Is Not Getting Worse The banking panic appears to have receded, at least for the time being. The Federal Reserve on Thursday released its weekly balance sheet report, affectionately known as “factors affecting reserve balances” or “H.4.1”

Treasury Secretary Janet Yellen will say on Thursday that regulators may have to tighten banking rules in the wake of the banking crisis.

In a system of competitive banking, there will always be banks that misjudge the risks they face, and sometimes this will mean they fail.

North Carolina-based First Citizens Bank and Trust has purchased Silicon Valley Bank (SVB), the tech industry favorite that collapsed earlier this month amidst an historic bank run.

Europe’s banking sector is not in crisis despite the collapse of two major players on the continent, a sector official in France has said.

The U.S. banking system “remains sound” and Americans can feel “confident” about their deposits with no need to panic over recent events, Treasury Secretary Janet Yellen is set to tell the Senate Finance Committee on Thursday.

Warnings have emerged of a wider banking collapse, with a leading financial expert warning that Credit Suisse may be the next to fall.

Steps to prevent a global banking crisis after the historic failure of Silicon Valley Bank (SVB) continued Monday, with governments in the UK, France, and Israel joining the U.S. to reassure institutions exposed to the fallout.

Climate change activists in Washington, DC, took to the streets Friday morning in an effort to “shut down business-as-usual for the financial institutions” and blocked traffic, frustrating some D.C. commuters and putting one man on the verge of being late for his scheduled colonoscopy.

Climate change protesters frustrated a D.C. driver during morning rush hour during a planned climate strike on Friday, prompting him to remind them that they were causing him to “burn more gas by sitting here.”

Left-wing activists plan to use Friday in Washington, DC, to march and “shut down business-as-usual” for the banks and financial institutions they say profit from “the climate crisis and immigrant detention.”

Joe Biden sided with his top donor, the one time credit card giant MBNA Corp., over progressives like Sen. Elizabeth Warren (D-MA) on bankruptcy reform during the late 1990s and early 2000s.

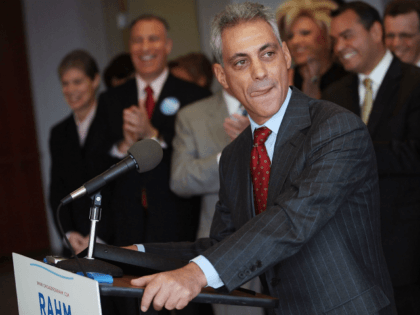

Chicago Mayor Rahm Emanuel (D) wants to use city contracts to punish banks that will not restrict and/or regulate clients involved in the firearms industry.