The Bank Panic Is Not Getting Worse

The banking panic appears to have receded, at least for the time being.

The Federal Reserve on Thursday released its weekly balance sheet report, affectionately known as “factors affecting reserve balances” or “H.4.1” to its closest friends. It suggested at the very least a respite from the turmoil that gripped the banking sector earlier in the month.

The average amount of loans from the Federal Reserve actually increased in the seven days through Wednesday compared with the week before, rising $17.2 billion to $358.9 billion. But by the end of the period, loans were down to $342.7 billion, down from the week earlier figure of $354.2 billion. This likely indicates that borrowing peaked sometime last week and has been retreating since.

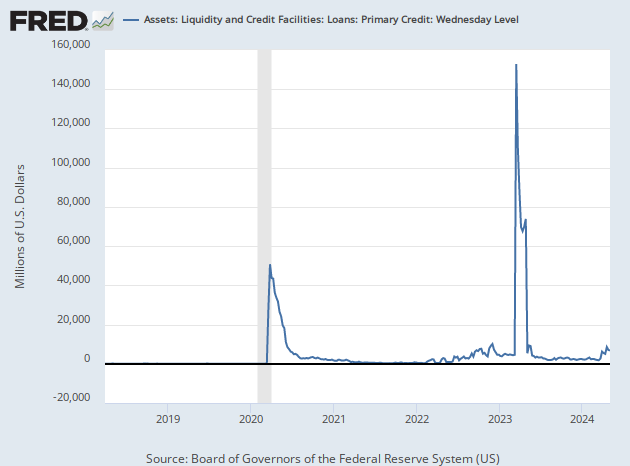

Borrowing through the traditional “lender of last resort” facility, the discount window or primary credit facility, fell from $110.2 billion as of last Wednesday to $88.2 billion. Average borrowing during the week was down $12.1 billion to $104.9 billion. Again, the difference between the average borrowing in the week and the outstanding at the end of the week suggests an ongoing downward trend.

The Fed’s new emergency facility, the Bank Term Funding Program, saw an increase in usage, from $53.7 billion a week ago to $64.4 billion on Wednesday. Here the average borrowing of $62.6 billion was below the end-of-period level, suggesting a slight upward trend in borrowing. Compared to the week before, average borrowing was up by $28 billion.

It’s very likely some of the increase in the term funding program resulted from banks recycling from discount window loans. With the appropriate collateral, the terms of the term funding facility are much more attractive. Some banks that initially turned to the more familiar discount window have now switched over to the new program.

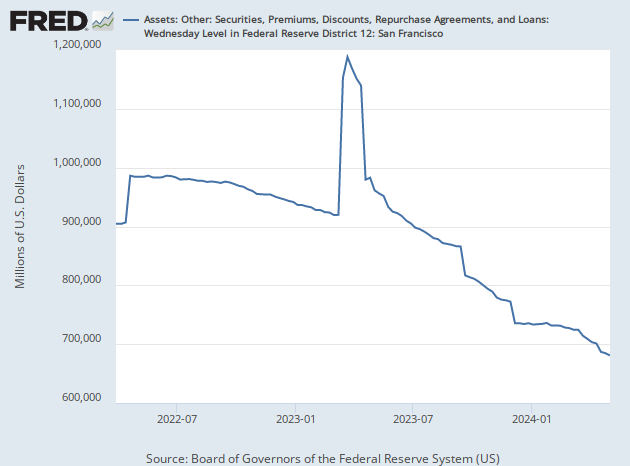

This is still a very high level of borrowing by banks and hardly a sign that the problems for the sector have been resolved. That said, it does not appear that the crisis is spreading or accelerating. Even if we zoom into the balance sheet at the Federal Reserve Bank of San Francisco, we see a decline in loans, indicating stabilization.

There also does not seem to be much international fallout from the worries about U.S. regional banks. Borrowings through the Fed’s central bank swap lines dipped $2 million to $585 million, a relatively small figure. By contrast, the 2008 financial crisis saw swap line borrowings jump to $600 billion, and the 2020 pandemic saw $450 billion in borrowings. This suggests no real strains on dollar funding around the globe.

Consumers and Businesses Were Not Shaken by Bank Turmoil

Financial crises can have a big psychological impact on the household and business sectors, depressing consumer spending and business hiring. Perhaps because of the swiftness of the official response to the collapse of Silicon Valley Bank, there does not seem to have been much of a fear contagion.

Consumer sentiment, as measured by the University of Michigan survey, remains in the doldrums and declined sharply from the prior month. But the final March reading was not far below the mid-month reading, which was based on information gathered before the collapse of Silicon Valley Bank.

A Brinks armored truck is parked in front of the shuttered Silicon Valley Bank (SVB) headquarters on March 10, 2023, in Santa Clara, California. (Justin Sullivan/Getty Images)

“This month’s turmoil in the banking sector had limited impact on consumer sentiment, which was already exhibiting downward momentum prior to the collapse of Silicon Valley Bank,” Joanne Hsu of the University of Michigan said in Friday’s report.

Another factor preventing the panic is likely the fact that most Americans do not associate the fate of the high-flying tech industry with their own financial well-being. The collapse of Silicon Valley Bank was rightly viewed as being very much tied to Silicon Valley rather than the broader American economy.

Fed on Track for at Least One More Hike

While there likely will be some tightening of financial conditions in the months ahead as banks hoard liquidity and raise lending standards, this will likely take several months to hit the real economy. That means the economy is likely to keep growing, the labor market is likely to stay tight, and inflation is likely to continue to run at a high level.

The personal consumption expenditure price index rose 0.3 percent in February, down from 0.6 percent in January. The Cleveland Fed’s calculation of median inflation, however, was at 0.4 percent. That puts it about where it has been for five out of the last six months—the exception being January, when it ran up to 0.6 percent. In other words, there’s no real sign of progress at all when it comes to underlying inflation.

Absent another bout of financial unrest, we expect that the settling down of the banking sector post-Silicon Valley Bank collapse will largely remove financial stability from the Fed’s agenda by the May meeting. The focus will be on inflation and, given its persistence, this augers for another hike.

COMMENTS

Please let us know if you're having issues with commenting.