House Freedom Caucus Opposes Bank Bailouts

The House Freedom Caucus said in a statement on Monday that they oppose bailing out the banking industry for what should be considered a failure of regulators not to see the coming crisis.

The House Freedom Caucus said in a statement on Monday that they oppose bailing out the banking industry for what should be considered a failure of regulators not to see the coming crisis.

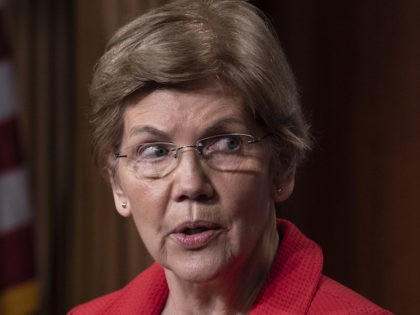

Senator Elizabeth Warren (D-MA) said Sunday on NBC’s “Meet the Press” that Federal Reserve Chair Jerome Powell “took a flamethrower to the regulations” on banks.

On Friday’s broadcast of CNN International’s “First Move,” Harvard University Economics Professor and former Chief Economist at the International Monetary Fund Ken Rogoff wondered how the San Francisco Federal Reserve didn’t know about the problems inside Silicon Valley Bank and

As of March 15, the level of borrowings from the Federal Reserve’s liquidity and credit facilities had risen nearly 2,000 percent from the prior week.

Manufacturing activity in the Philadelphia area declined again in March, the Federal Reserve Bank of Philadelphia said on Thursday.

The chances of the United States falling into a recession in the next 12 months have increased to 35 percent because of the “near-term uncertainty around the economic effects of small bank stress,” Goldman Sachs warned Thursday.

On Wednesday’s broadcast of MSNBC’s “Morning Joe,” Steve Rattner, who served as counselor to the Treasury Secretary in the Obama administration, stated that the core services inflation metric that the Federal Reserve “really looks at” is “rising and that is not

It seems very unlikely that the Federal Reserve will end its rate hike cycle.

On Tuesday’s broadcast of CNN International’s “One World,” Harvard University Economics Professor and former International Monetary Fund Chief Economist Ken Rogoff argued that “inflation’s deeply embedded in the rest of the economy.” And the Federal Reserve will have to keep

On Tuesday’s broadcast of CNN International’s “First Move,” Moody’s Analytics Chief Economist Mark Zandi stated that the February inflation report does justify a hike in interest rates because inflation is “still a little on the hot side.” But, given the

On Monday’s “CNN Newsroom,” Deputy Assistant Secretary for Economic Policy at the Department of Treasury during the Obama administration and Brookings Institution Senior Fellow Aaron Klein stated that there were bailouts of the depositors of Silicon Valley Bank (SVB) and

The Federal Reserve on Monday announced plans to conduct an internal review of the oversight of Silicon Valley Bank (SVB) after the bank’s abrupt failure last week.

“We could be on tenterhooks all week waiting to see who else is getting taken out,” Breitbart Economics Editor John Carney told Fox Business host Larry Kudlow.

Breitbart Economics Editor John Carney said in an interview on Saturday on Larry Kudlow’s eponymously named radio show that a government bailout of the collapsed Silicon Valley Bank could deepen the panic.

President Joe Biden on Sunday took credit for creating a new lending mechanism to backstop banks after the banking meltdown over the weekend in which two banks collapsed due in part to increased interest rates meant to tamp down Biden’s soaring inflation.

The U.S. government on Sunday sought to affirm confidence in the U.S. banking system by announcing protection for all depositors in Silicon Valley Bank. Treasury Secretary Janet Yellen approved measures to resolve the failure of Silicon Valley Bank “in a

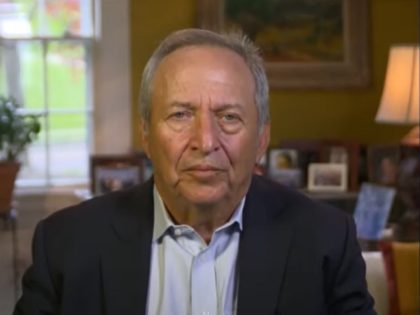

During an interview aired on Friday’s edition of Bloomberg’s “Wall Street Week,” Harvard Professor, economist, Director of the National Economic Council under President Barack Obama, and Treasury Secretary under President Bill Clinton Larry Summers argued that “we don’t have a

The “cheap money ecosystem” that fed the tech start-up culture has come to an end with the Federal Reserve raising interest rates to curb inflation, and the failure of Silicon Valley Bank might be the first domino to fall among California-based financial institutions, Breitbart Economics Editor John Carney said in an interview Friday with Fox Business host Larry Kudlow.

Chris Whalen, chairman of Whalen Global Advisors, blamed Federal Reserve Chair Jerome Powell for the failure of Silicon Valley Bank (SVP) in a Friday interview on Forward Guidance with host Jack Farley.

The market’s expectations for the rate hike coming out of the March meeting of the Federal Open Market Committee (FOMC) moved violently on Tuesday as the Fed chief testified before the Senate Banking Committee.

Sen. Bob Menendez (D-NJ) used a Senate Banking Committee hearing with Federal Reserve Chair Jerome Powell to excoriate President Joe Biden for not appointing more Latinos to the Federal Reserve board.

Hotter than expected data has forced the Fed to rethink the pace and peak of interest rates.

During an interview aired on Friday’s edition of Bloomberg’s “Wall Street Week,” Harvard Professor, economist, Director of the National Economic Council under President Barack Obama, and Treasury Secretary under President Bill Clinton Larry Summers stated that public pressure by progressive

The services sector index for February shows that progress on inflation has definitely stalled as demand for services remains strong.

A highly anticipated speech by Fed Governor Christopher Waller was scrapped after a participant in the Zoom call started showing porn to the audience.

The Federal Reserve officials may “chicken out” from raising interest rates at their next meeting, Breitbart Economics Editor John Carney told Fox Business’ Larry Kudlow.

The personal consumption expenditure data released Friday confirmed the January inflationary boom.

The Fed’s policy stance increased looks like it is “insufficiently restrictive” to rein in demand for labor.

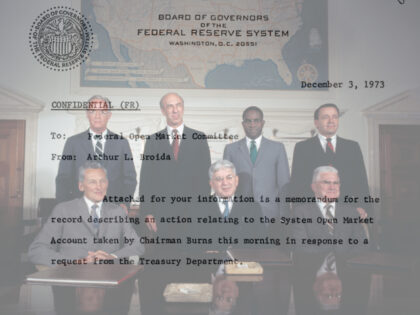

A formerly-confidential memo from half a century ago suggests that the Federal Reserve may have a failsafe in the event of a protracted debt ceiling fight.

The Fed wants to see inflation on a sustained path downward.

Following a week of data showing unexpectedly resurgent inflation, fed funds futures contracts now indicate the Federal Reserve will hike its target rate up by half a percentage point in the coming months.

The Federal Reserve is going to have to monetize the national debt to finance it, Breitbart Economics Editor John Carney said in an interview Wednesday on Larry Kudlow’s eponymously named Fox Business show.

President Biden is planning to tap Federal Reserve Vice Chair Lael Brainard to serve as director of the National Economic Council, according to a Wall Street Journal report.

The Federal Reserve is likely to have to keep raising interest rates to a “sufficiently restrictive level” to bring down inflation, Federal Reserve Governor Michelle Bowman said Monday. “I expect that ongoing increases will be appropriate to bring the federal

Former Federal Reserve governor and chief executive officer at The Lindsey Group Lawrence Lindsey said Monday on CNBC’s “The Exchange” that Fed Chair Jerome Powell had the “most counterproductive press conference” while announcing the Federal Reserve raised its benchmark interest rate by a quarter point.

FRANKFURT, Germany (AP) – The European Central Bank chugged ahead with another outsized interest rate hike Thursday and vowed more to come, underlining its drive to subdue inflation even as the European economy slows and the U.S. Federal Reserve eases its pace of increases.

Fed chairman Jerome Powell described the labor market as extremely tight. Jobless claims indicate that it may be getting even tighter.

FRANKFURT, Germany (AP) – The European Central Bank is set for another large interest rate increase to fight painfully high inflation even after the U.S. Federal Reserve slowed its pace, a divergence that underlines Europe’s later start and could speed the euro’s rebound from recent lows against the dollar.

The Fed’s benchmark rate is now the highest it has been since 2007.

The Federal Reserve’s preferred inflation gauge eased further in December, and consumer spending fell — the latest evidence that the Fed’s series of interest rate hikes are slowing the economy.