Elizabeth Warren Slams Fed’s Interest Rate Hike as ‘Extreme’

Sen. Elizabeth Warren (D-MA) issued sharp criticism directed at the Federal Reserve over its decision to once again raise interest rates by 75 basis points.

Sen. Elizabeth Warren (D-MA) issued sharp criticism directed at the Federal Reserve over its decision to once again raise interest rates by 75 basis points.

Fed officials now see a much higher unemployment rate and much lower path for GDP growth.

Investors had expected a 75 basis point raise, although markets indicated an outside chance of an even larger hike.

The Federal Reserve is convinced that inflation expectations are extremely important. But are they right about which inflation expectations? The consensus view among Fed officials appears to be that longterm inflation expectations deserve the most attention. When Fed officials look

On Wednesday’s broadcast of MSNBC’s “Morning Joe,” Steve Rattner, who served as counselor to the Treasury Secretary in the Obama administration, stated that the government “went too far in trying to mute the effects of the pandemic, too much stimulus” in

During a portion of an interview with CBS aired on Wednesday’s edition of “CBS Evening News,” Treasury Secretary Janet Yellen declined to say that inflation is near its peak and stated she doesn’t want to insert herself into forecasting things

During an interview aired on Thursday’s edition of Comedy Central’s “Daily Show,” Labor Secretary Marty Walsh stated that while “the Fed has said, at some point, having a little bit of unemployment might be good,” he wants “to do everything

The Fed chairman’s responses to a Cato Institute Q&A appeared to confirm that the Fed is planning a jumbo 75 basis point rate hike this month.

Fed officials are likely to increase their interest rate target by three-quarters of a percentage point at their policy meeting this month.

The Federal Reserve’s beige book described the economy as “unchanged” from July, indicating little growth in some regions and a shrinking economy in others.

On Wednesday’s broadcast of West Virginia MetroNews’ “Talkline with Hoppy Kercheval,” Federal Reserve Bank of Richmond President and CEO Tom Barkin stated that while fiscal and monetary stimulus was needed in early 2020, “if you look at 2021, there was still

The number of open jobs in the United States rose in July, defying predictions that vacancies would fall for a fourth straight month and dashing hopes that the Federal Reserve’s monetary policy tightening had already throttled demand for labor.

Senator Elizabeth Warren (D-MA) said Sunday on CNN’s “State of the Union” that she is “very worried” that the Federal Reserve will “tip this economy into a recession.”

(AFP) – European natural gas prices climbed Thursday towards a record peak on heightened fears over Russian supplies, while equities rose on the eve of a key speech from Federal Reserve Chair Jerome Powell.

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation,” Powell said.

Consumer spending grew by less than expected, helping cool core prices in July.

Home affordability is declining steeply as the Fed hikes rates to cool inflation.

There was good news for Jerome Powell in the National Association of Business Economist survey released Monday: the Fed’s policy has become a lot more popular.

During an interview aired on Friday’s edition of Bloomberg’s “Wall Street Week,” Harvard Professor, economist, Director of the National Economic Council under President Barack Obama, and Treasury Secretary under President Bill Clinton Larry Summers reacted to recent minutes from the

Next week Jerome Powell will find himself facing down financial markets at the feet of the Teton Mountains in Jackson Hole, Wyoming, each standing in the summer heat daring the other to blink first.

Fed officials are talking as if they are determined to bring down inflation even if it means a recession. Investors are not yet convinced.

The market continues to show skepticism about the Fed’s commitment to keep raising rates to fight inflation.

On Tuesday’s broadcast of Bloomberg’s “Balance of Power,” White House National Economic Council Director Brian Deese stated that the declining housing market is “the intended result of the Fed’s tightening efforts.” Host David Westin asked, [relevant exchange begins around 17:05]

The Federal Reserve allegedly withheld key documents that could have severely impacted a Federal Reserve nominee ahead of a potential confirmation vote, leading many to call for increased transparency and reform for the nation’s central bank.

On Wednesday’s broadcast of Bloomberg’s “The Open,” White House National Economic Council Director Brian Deese responded to concerns by the Federal Reserve about growing wages putting pressure on inflation and Fed officials saying that unemployment needs to rise by stating

The Department of Labor released an unexpectedly strong jobs report, shifting economists expectation about the the Fed’s next rate hike.

On Tuesday’s broadcast of CNBC’s “Closing Bell,” Sen. Joe Manchin (D-WV) responded to a question on who should be blamed for inflation by stating that it’s “not my job here to blame people. You want to blame people, you’ll never

The mortgage debt rose 1.9 percent this past quarter as the housing market continues to soar coming out of the pandemic.

Retail and construction openings crashed in June as the Fed raised interest rates at the fastest pace in decades.

Former Treasury Secretary Lawrence Summers said Friday on MSNBC’s “Andrea Mitchell Reports” the Federal Reserve’s confidence that interest rate hikes will avoid a recession and give the U.S. economy a soft landing is “tooth fairy kind of stuff.”

Candidate Joe Biden promised to get the United States out of the recession caused by the coronavirus and the subsequent economic shutdowns when he ran for president in 2020.

Federal Reserve Chairman Jerome Powell said Wednesday that he does not believe the U.S. is currently in a recession, citing the fact that job vacancies are still above 11 million, unemployment is near record lows, and hiring has been brisk.

Senator Elizabeth Warren (D-MA) said Sunday on CNBC’s “Squawk Box” that the Federal Reserve should not raise interest rates so aggressively because it could cause a recession.

The Fed pushed rates higher again in an effort to tame four-decade high inflation.

During an interview on MSNBC on Tuesday, Council of Economic Advisers Chair Cecilia Rouse stated that the Federal Reserve’s monetary policy “is starting to slow down the economy” and that it has “been in that gentle way that we would hope.”

On Tuesday’s broadcast of Bloomberg’s “Balance of Power,” Senate Homeland Security Committee Ranking Member Sen. Rob Portman (R-OH) discussed a report from the committee’s minority staff finding that “For over a decade, China has engaged in a sustained malign influence

There’s no doubt that the Federal Reserve is going to raise its interest rate target at the end of tomorrow’s meeting of the Federal Open Market Committee. What we do not know is how much they will raise.

Sales of new homes in the U.S. plunged 8.1 percent to a seasonally-adjusted annual rate of 590,000 in June, a far slower pace than expected by economists.

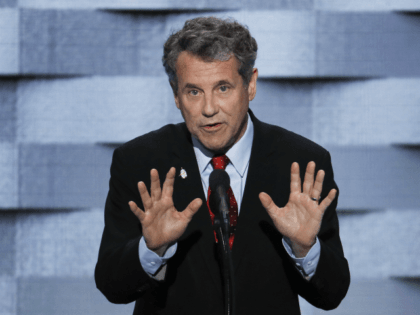

On Thursday’s broadcast of Bloomberg’s “Balance of Power,” Senate Committee on Banking, Housing, and Urban Affairs Chairman Sen. Sherrod Brown (D-OH) responded to a question on what Congress can do to ensure the Federal Reserve doesn’t repeat the mistakes it

China’s state-run Global Times on Tuesday denounced the strong U.S. dollar as a “crisis” for the rest of the world because it increases the “financial risks facing emerging markets” and allegedly makes it harder for other nations to implement anti-inflationary policies.