President Donald Trump’s administration is hosting a summit in Washington, DC, to discuss how the proposed Trump Accounts will financially benefit young Americans in the years to come.

The summit, hosted by the U.S. Department of the Treasury, will be held on Wednesday as the administration works to “strengthen long-term financial security, expand access to capital, and promote economic opportunity for American families,” the department said.

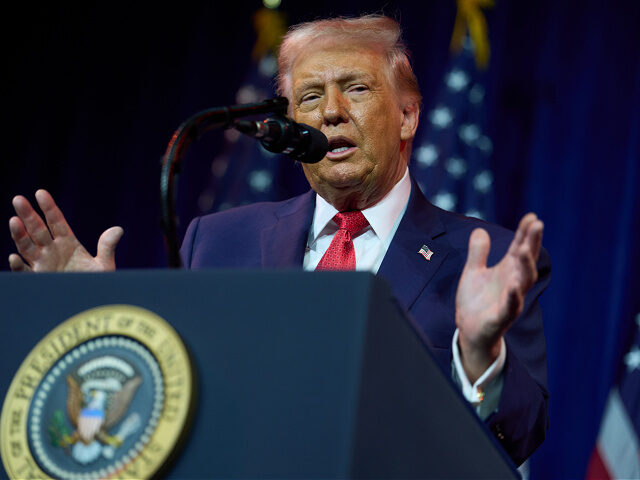

President Trump and Treasury Secretary Scott Bessent are scheduled to speak during the event that will also feature senior administration officials, everyday Americans, and stakeholders.

The conversation will center around the program’s economic impacts and how the Trump administration is committed to offering more financial opportunity for families across the United States.

The Treasury Department’s announcement continued:

President Trump’s Working Families Tax Cuts include a new revolutionary program – Trump Accounts – giving the future of America, a stake in America. Trump Accounts allows parents, guardians, or other custodians to establish a new type of tax-advantaged individual retirement account for their children. Children born between January 1, 2025, and December 31, 2028, are eligible to receive $1,000 from Treasury as a pilot program contribution. In addition to the pilot program, parents can contribute up to $5,000/year, and employers up to $2,500/year.

According to the Trump Accounts website, the program will “jumpstart the American Dream” for citizens under the age of 18.

The summit will also be live-streamed on Wednesday:

Trump announced the government savings accounts launch in December, and along with his announcement billionaires Michael and Susan Dell together pledged $6.25 billion to fund the investment accounts, Breitbart News reported at the time.

Bessent later said the accounts will be “transformative” in promoting and furthering financial literacy across the nation, according to Breitbart News.

The outlet noted that “Children cannot withdraw from the account until they are 18, and they also have the option to let it continue to compound once of age, in which case it will be treated like an IRA.”

COMMENTS

Please let us know if you're having issues with commenting.