Netflix is officially a dog stock, with shares of the left-wing streaming giant losing a whopping 40 percent of their value since the start of 2022 amid anemic new customer figures and analyst downgrades, all of which point to a rockier future ahead for the once invincible company.

Shares of Netflix — which has a production deal with former President Barack Obama — were down nearly 12 percent in morning trading Monday after the stock plummeted more than 20 percent Friday after the streamer reported weaker-than-expected subscriber results for the fourth quarter and a pessimistic outlook for the first quarter of the new year.

And now there’s even more bad news: a new study estimates Netflix could lose hundreds of thousands more subscribers as several Disney-owned hit shows including Modern Family and Sons of Anarchy are leaving the streamer in the U.K. and migrating to Disney+.

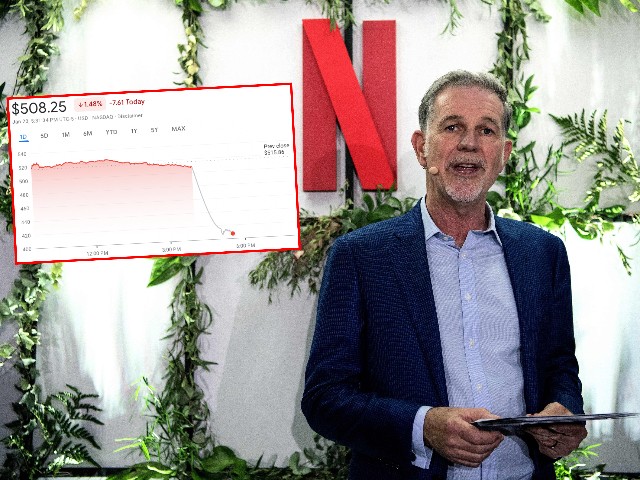

Co-founder and director of Netflix Reed Hastings delivers a speech as he inaugurates the new offices of Netflix France, in Paris on January 17, 2020. – Hastings announced some 20 French projects by Netflix on January 17, 2020. (Christophe ARCHAMBAULT / AFP)

Analysts at the research firm Digital i estimate Netflix could lose as many as 750,000 customers in Great Britain as these titles ranked among the most-streamed in Europe, according to report in the Guardian.

It’s part of a larger trend that has seen legacy Hollywood studios remove more of their content from Netflix in order to build their own streaming services. Disney+ and HBO Max are moving aggressively to lure customers away from the competition as consumers grow more reluctant to subscribe to multiple streaming services and seek to consolidate their at-home entertainment options.

The avalanche of negative news has prompted several analysts to downgrade Netflix shares. Morgan Stanley analyst Benjamin Swinburne slashed the stock’s target price from $700 to $450, saying the weak subscriber growth has significantly impacted the company’s earnings outlook, according to multiple reports.

Macquarie Research’s Tim Nollen had an even more negative prescription, downgrading the stock from “neutral” to “underperform” and cutting the price target from $615 to $395.

Netflix has blamed the recent quarter’s weak subscriber growth on the COVID-19 pandemic while also citing growing streaming competition. As usual, the company didn’t address consumer disenchantment with its increasingly woke, left-wing content, including the climate-change satire Don’t Look Up and the titles produced under the Obama’s production banner.

Netflix’s top executives are among Hollywood’s most active fundraisers for Democrats. Co-CEO Reed Hastings donated $3 million to help California Gov. Gavin Newsom (D) fight off the recentrecall effort — the largest amount at the time to the Stop The Republican Recall fund.

Both Hastings and co-CEO Ted Sarandos backed Joe Biden’s bid for the White House.

Follow David Ng on Twitter @HeyItsDavidNg. Have a tip? Contact me at dng@breitbart.com

COMMENTS

Please let us know if you're having issues with commenting.