Breitbart Business Digest: The Fed’s Strange New Battle Lines

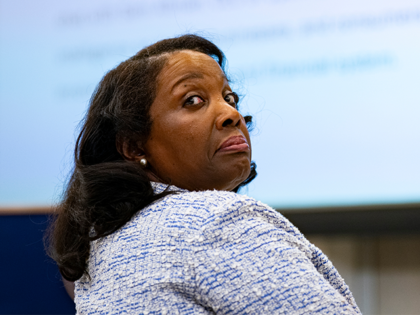

Donald Trump gained an unexpected ally Monday in his fight with the Federal Reserve: Governor Lisa Cook, the Fed official he attempted to fire this summer.

Donald Trump gained an unexpected ally Monday in his fight with the Federal Reserve: Governor Lisa Cook, the Fed official he attempted to fire this summer.

The Federal Reserve reduced its interest rate benchmark by a quarter-point for a second time this year on Wednesday, bringing the short-term borrowing rate to a range of 3.75 percent to four percent.

A new paper from researchers at the Boston Fed warns of another inflation surge. But their warning rests on questionable measurement choices, contradictory data, and a misleading citation of academic research.

The St. Louis Federal Reserve released a study claiming that Trump’s tariffs added roughly 0.5 percentage points to consumer inflation. There’s just one problem: the study didn’t actually show that.

Trump’s immigration policy is pressuring Texas employers to raise wages, recruit sidelined Americans, and invest in productivity-boosting technology, according to the Federal Reserve Bank of Dallas.

Minutes show a central bank torn between members who see inflation as largely vanquished and those who believe the fight has “stalled,” and split on whether the economy needs a gentle policy adjustment or aggressive stimulus.

The Supreme Court declined Wednesday to immediately remove Federal Reserve Governor Lisa Cook from her position, leaving her in place at least until the justices hear arguments in the case in January.

The Labor Department said it would suspend publication of the monthly jobs report and other major economic data if the government shuts down, including the Consumer Price Index and Producer Price Index, cutting off critical information for businesses, investors and

Core inflation slowed down in August, the Federal Reserve’s preferred gauge showed Friday, suggesting President Trump’s tariffs are not creating significant price pressures for American households.

A bipartisan who’s who of the economic establishment has fired a fusillade of foolscap at the Supreme Court, insisting that President Trump must not be allowed to remove Fed Governor Lisa Cook.

A bipartisan roster of former Treasury secretaries, Federal Reserve chairs and other senior economic policymakers asked the Supreme Court to stop President Donald Trump from removing Fed Governor Lisa Cook, warning that the central bank’s independence and the economy’s stability

When economists talk about immigration, they usually focus on jobs, wages, or fiscal costs. Federal Reserve Governor Stephen Miran wants to add another dimension: interest rates.

Federal Reserve officials are sharply divided over how aggressively to cut interest rates, with some warning that the central bank risks falling dangerously behind in addressing a deteriorating labor market while others remain focused on stubborn inflation that has persisted well above target for more than four years.

The September purchasing managers’ indexes from S&P Global showed companies in manufacturing and services reported sharply higher input costs, which they primarily attributed to tariffs. But weak demand and fierce competition prevented most from raising prices, leading to the weakest goods inflation since January.

Speaking at the Economic Club of New York, Miran argued that the Fed’s benchmark rate should be closer to two to 2.5 percent, roughly two points below its current level.

Jimmy Kimmel might have hastened his exit by spreading falsehoods about Charlie Kirk’s assassin, but he was marching toward the end long before this week.

The fight over Lisa Cook’s seat on the Board of Governors of the Federal Reserve turns on a deceptively simple question: does a Fed governor have a property right in exercising their power over monetary policy?

Administration argues courts shouldn’t second-guess presidential judgment when Congress gives broad removal power

The lender in two home loans made to Treasury Scott Bessent in 2007 knew they were not his primary residences.

Central bank reduces benchmark rate by a quarter percentage point in first cut of 2025, as officials navigate extraordinary political pressures and economic uncertainty.

The D.C. Circuit Court of Appeals handed Federal Reserve Governor Lisa Cook a temporary victory against President Trump. Here’s why the Supreme Court will likely reverse this.

The Trump administration remains unconvinced in Federal Reserve Governor Lisa Cook’s case as establishment media obtained loan estimates that are being used to claim she did not allegedly commit mortgage fraud.

Senate Banking Committee Chairman Tim Scott (R-SC) on Monday told Breitbart News that confirming White House Council of Economic Advisers (CEA) Chairman Stephen Miran to the Federal Reserve Board will help guide the country to “stronger domestic production” and lower trade imbalances.

A divided federal appeals court on Monday refused to let President Donald J. Trump immediately oust Federal Reserve Governor Lisa D. Cook, but a forceful dissent warned that the decision misapplied both constitutional law and common sense.

The Senate on Monday confirmed Stephen Miran, chairman of the White House Council of Economic Advisers, to a seat on the Federal Reserve Board, giving President Donald Trump an influential voice inside the central bank at a critical moment for monetary policy.

Welcome to the inaugural Friday Wrap, our weekly survey of the economy, Wall Street, Silicon Valley, and the bureaucrats who pretend they can read the future by staring at spreadsheets.

The committee voted 13-11 along party lines to advance Miran’s nomination to the full Senate, where it is expected to come up for a vote on Monday.

President Donald Trump on Wednesday appealed a federal judge’s order that prevented him from firing Federal Reserve Governor Lisa Cook, escalating a legal fight over the president’s power to reshape the central bank. The appeal, filed in the U.S. Court

A federal judge on Tuesday blocked President Donald Trump from removing Lisa Cook from the Board of Governors of the Federal Reserve, ruling that his attempt to oust her over unproven mortgage-fraud allegations likely violated federal law and her constitutional

Prices paid to U.S. businesses unexpectedly fell in August, putting pressure on the Federal Reserve to cut interest rates and undercutting claims that the Trump administration’s tariffs would cause inflation to pick up.

For two years in a row, the cheerleaders of Bidenomics assured us that any discontent was in our heads—a trick of bad vibes and social media. It turns out the voters were right, and the official statistics were wrong.

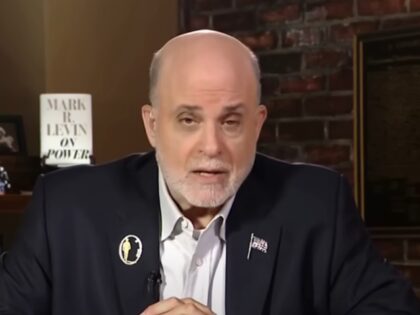

Sunday on Fox News Channel’s “Life, Liberty & Levin,” host Mark Levin deemed the Federal Reserve Board “unconstitutional.”

Stephen Miran, President Trump’s nominee for an open Federal Reserve position, appeared to reassure Republican lawmakers about his commitment to central bank independence Thursday, weathering a barrage of attacks from Democratic senators during his confirmation hearing. Miran, who serves as

The Justice Department issued subpoenas and opened a criminal inquiry into allegations that fired Federal Reserve governor Lisa Cook has committed mortgage fraud, according to a Thursday report.

Federal Reserve governor Lisa Cook’s lawyer said that she “did not ever commit mortgage fraud,” in a court filing on Tuesday.

Nolte: Keeping track of the “primary residences” of Lisa Cook is even more complicated than keeping track of all the estates owned by socialist Sen. Bernie Sanders.

Roughly 600 economists, including former Biden and Obama staffers, signed an open letter pushing back on President Donald Trump’s move to fire Federal Reserve governor Lisa Cook as the Trump administration shared a video about her mortgage fraud.

Lisa Cook, whom President Donald Trump has sought to fire from her position as Federal Reserve governor over allegations of mortgage fraud, once said that economists could have caught the 2008 financial crisis earlier if they had paid attention to “mortgages that were pitched to African-Americans.”

On Friday, on MSNBC’s “The Weeknight,” Rep. Debbie Wasserman Schultz (D-FL) said that President Donald Trump would “tank the dollar” if he eliminates the independence of the Federal Reserve.

This week saw a series of unprecedented events that may signal the end of the form of central bank independence as we have known it for more than a century.