Canada Braces for Wave of Bankruptcies After Ending Pandemic Support

Canada braces for a wave of small business bankruptcies as pandemic emergency loans come due, but business is still down.

Canada braces for a wave of small business bankruptcies as pandemic emergency loans come due, but business is still down.

Nearly $2 billion in federal funding went to abortion advocacy groups between 2019 and 2021, according to a Government Accountability Office (GAO) report requested by Republican lawmakers.

On Thursday’s broadcast of MSNBC’s “Morning Joe,” Steve Rattner, who served as counselor to the Treasury Secretary in the Obama administration, and also serves as the show’s Economic Analyst, stated that default rates on credit cards and auto loans have

The UK Guardian noted on Monday that China has become the “world’s biggest debt collector” thanks to the massive loans poor nations took out from Chinese banks to finance Belt and Road Initiative (BRI) infrastructure projects.

Left-wing publications, like the New York Times, the Atlantic, and ProPublica, have been engaged in a smear campaign against conservative Supreme Court Justice Clarence Thomas in recent months — an effort a D.C. insider and close friend of the justice says is “part of Left’s effort to undermine [the] Court and ultimately pack it.”

Christmas Tree Shops is reportedly preparing to shut down all of its 82 locations after initially planning to close just ten.

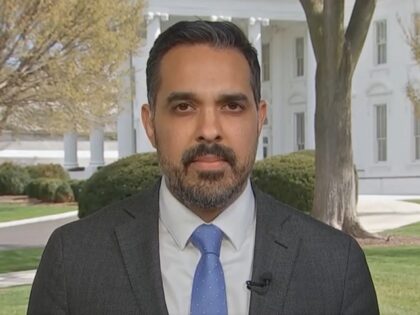

On Wednesday’s broadcast of CNBC’s “Squawk on the Street,” White House National Economic Council Deputy Director Bharat Ramamurti stated that if there is a credit crunch, the Small Business Administration (SBA) “may have some authorities to step in and fill the

Navy sailors who recently earned increases in housing allowances due to marriage or relocating to a more expensive area are noticing months-long delays in their pay raise, according to Military.com.

Rep. Tom Tiffany grilled Attorney General Merrick Garland at a House Judiciary Committee hearing on basing federal loan forgiveness on race.

A report published Wednesday by the AidData project at the College of William & Mary in Virginia found that China’s Belt and Road Initiative (BRI), touted by Communist China as a partnership to help emerging economies, has mostly profited China while leaving its “partners” mired in crushing debt.

The government of Cameroon said on Monday it was investigating how ministers had spent $335 million in coronavirus aid from the International Monetary Fund (IMF) amid accusations from opposition parties that most of the loaned funds “could not be accounted for.”

Federal prosecutors are accusing a California man of fraudulently obtaining $5 million in coronavirus relief Payment Protection Program (PPP) loans and spending the money on luxury cars.

Sheikh Abdullah bin Zayed al-Nahyan, foreign minister of the United Arab Emirates (UAE), told his Pakistani counterpart Shah Mahmood Qureshi on Tuesday the UAE will roll over a $2 billion loan and “extend every possible support” in an effort to improve relations between the two countries.

Italy’s mafia is seeking to profit from the Chinese coronavirus pandemic by soliciting small businesses and poor families that are facing financial ruin over the virus, prosecutors told Reuters.

Robert Francis “Beto” O’Rourke told BET viewers Saturday of his plan to expand capital for black American communities.

Google is partnering with Indian banks to “bring quick loans to the masses,” according to a report.

Analysts with the proper degree of skepticism about China’s boasts of soaring economic power note that official reports from the Communist regime cannot be trusted. Another, less widely understood problem is that China’s rulers might not know how unstable their economy really is because a sizable portion of Chinese debt lurks off the books in the “shadow banking” industry.

Lending in the U.S. by foreign banks has started to contract.

The California High-Speed Rail Authority came up empty when it asked the outgoing administration of President Barack Obama for a $15 billion loan, the Los Angeles Times reports.

According to the New York Times, contrary to his campaign narrative about funding his successful 2012 Senate run by liquidating personal assets, Ted Cruz and his wife Heidi took out a loan for up to $500,000 from Goldman Sachs, where Mrs. Cruz worked.

President Barack Obama is bringing the subprime-mortgage crisis back, fueled by the progressives’ political urge to treat borrowed money loans as a “right” that everyone is “entitled,” and by the willingness to dismiss mathematical probability as a racist conspiracy.

Moms and dads paying their children’s college tuition take note: some of those colleges’ tuitions may be hiked because of expensive recreational pools the colleges offer their students.

The California Policy Center has just published an exhaustive study regarding the $149.2 billion Californians have borrowed over the last 14 years to finance public school construction. Despite the sob stories about dilapidated facilities, huge amounts of cash has been siphoned off due to union project labor agreements, environmentalist lawsuits, and inadequate planning and public oversight.

The Federal Housing Finance Agency (FHFA) decided Wednesday to increase compensation for CEOs at Fannie Mae and Freddie Mac – government sponsored enterprises (GSEs).

The Eurozone rejected Greece’s request for one-month bailout extension only a day after the bankrupt country turned down an extension offer from their creditors. “It looks like we are heading for Grexit,” exclaimed one person who participated in the meetings.

The Office of the Comptroller of the Currency (OCC), which regulates the financial risks posed by the lending activity of American national banks, has officially reported that banks are expanding sub-prime credit by raising borrowing limits for credit card holders. The new concerns follow an OCC report last June that flagged “problematic” recent high-risk corporate takeovers, car loans through auto dealers, and commercial finance lending.

Remember subprime loans? Well, they’re back. And this time, instead of funding the housing market, they’re being used to finance consumer debt.