After being featured Tuesday on The Daily Show with Jon Stewart, Breitbart News contributor and Government Accountability Institute President Peter Schweizer once again found himself the focus of national media in a 60 Minutes Sunday report highlighting his work uncovering congressional insider trading and championing the Stop Trading On Congressional Knowledge (STOCK) Act to ban it.

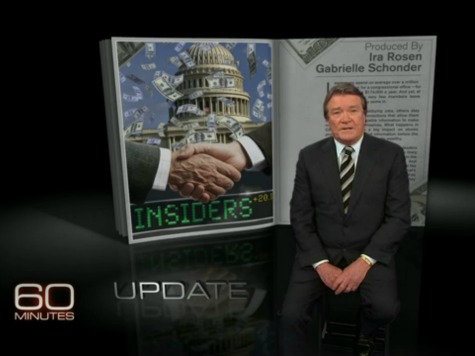

In 2011, 60 Minutes‘ veteran reporter Steve Kroft ran an investigative report based on Schweizer’s New York Times bestselling book, Throw Them All Out.

“A year ago he began working on a book about soft corruption in Washington with a team of eight student researchers who reviewed financial disclosure records,” said Kroft in the original 2011 CBS 60 Minutes report. “The results became a jumping off point for our own story, and we have independently verified the material we used.”

Kroft won the Joan Shorenstein Barone Award for excellence in Washington-based journalism for the report. Kroft thanked Schweizer at the awards ceremony and made a rare joint interview appearance with Schweizer on MSNBC.

After the release of Schweizer’s book and the award-winning 60 Minutes segment it sparked–as well as at least 26 articles by Breitbart News published on the subject–President Obama included the issue in his 2012 States of the Union Address. Eventually, Congress passed the bill in an overwhelming bipartisan vote of 417-2 in the House and 96-3 in the Senate.

Two weeks ago, however, Congress gutted the bill by killing a key provision that would have put already publicly available financial disclosure records of federal officials in an online format to increase transparency.

Sunday night, Steve Kroft took to the airwaves to hit back.

“Our 2011 report shamed Congress into passing the STOCK Act,” said Kroft. “But earlier this month, Congress quietly repealed parts of the law.”

Kroft’s 60 Minutes Sunday update featuring Peter Schweizer may have telegraphed to members of Congress a warning of sorts: neither he nor Schweizer are finished reporting on or exposing instances of insider trading and self-enrichment by members of Congress or their staffs.

COMMENTS

Please let us know if you're having issues with commenting.