British security chiefs are warning Communist China could use a Central Bank Digital Currency (CBDC) to monitor and control citizens – while the British state is itself working on a CBDC.

Sir Jeremy Fleming, who leads the Government Communications Headquarters (GCHQ) mass surveillance agency, used the Royal United Services Institute (RUSI) Annual Security Lecture at the Science Gallery in London to warn that the Chinese Communist Party (CCP) is haunted by “[f]ear of its own citizens, of freedom of speech, free trade, open technological standards and alliances – the whole open, democratic order and the international rules-based system” — and views CBDCs as a way to strengthen its grip.

“Control is… a major driver for Beijing as it seeks to build a centralised, digital currency,” Sir Jeremy told the near-200-year-old think tank.

“Yes, it introduces efficiencies and new ways of settling payments. But the way it’s being implemented allows the monitoring of citizens and it forces companies to use the service,” he continued, adding that a digital yuan might also enable the CCP to circumvent international sanctions of the sort being imposed on Russia due to its full-scale invasion of Ukraine in February.

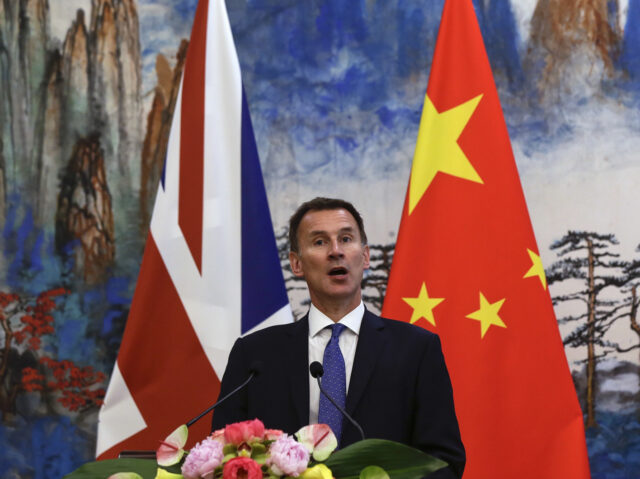

The irony, however, is that Britain’s nationalised central bank, the Bank of England, is itself working on a British CBDC, referred to as a digital pound, at the behest of Chancellor of the Exchequer Jeremy Hunt — a man with close personal links to China and a reputed admirer of China’s authoritarian model of government, at least with respect to lockdown.

Great Reset: UK Prepares to Introduce a 'Digital Pound' Central Bank Digital Currency https://t.co/YXy5CnUskK

— Breitbart London (@BreitbartLondon) December 11, 2022

Chancellor Hunt announced mere weeks ago that Prime Minister Rishi Sunak’s government was “bringing forward a consultation in the coming weeks to explore the case for a central bank digital currency – a sovereign digital pound – and consult on a potential design,” with the Bank of England tasked with producing “a Technology Working Paper setting out cutting-edge technology considerations informing the potential build of a digital pound.”

Promoted by the Davos-based World Economic Forum (WEF), CBDCs represent in some respect an answer to “currencies” like Bitcoin, which are not centrally controlled, and traditional cash, which is of course state-backed but also able to circulate without state authorities having excessive power to decide how, where, and with whom citizens can carry out transactions.

It may also prove to represent something of a challenge to the petrodollar system, particularly if Sir Jeremy’s warnings that it China and Russia — and perhaps the wider BRICS bloc, in time — could use it to do business outside the traditional structures of international finance.

COMMENTS

Please let us know if you're having issues with commenting.