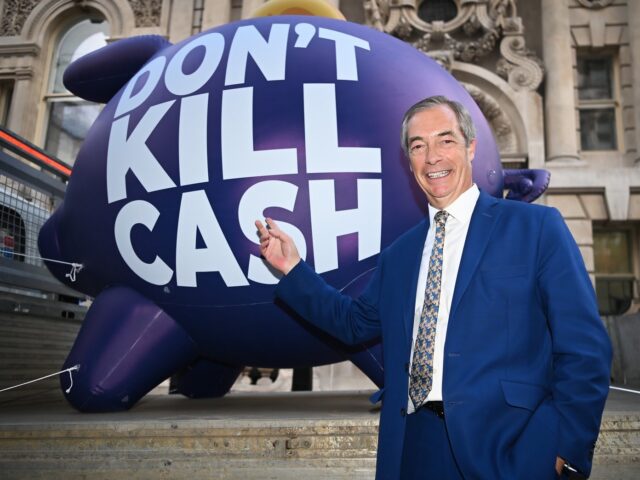

A petition against the cashless society organised by Brexit leader Nigel Farage and UK broadcaster GB News has reached 300,000 signatures, and was hand-delivered to Downing Street by Mr Farage on Thursday afternoon.

Nigel Farage, political leader-turned broadcaster and now key campaigner on the debanking scandal carried the Don’t Kill Cash petition to No. 11 Downing Street on Thursday. Flanked by his fellow petitioners and co-hosts from the GB News Network Mr Farage handed the list of names over at the door of the official residence and personal office of Jeremy Hunt, the UK Chancellor of the Exchequer (finance minister).

Arriving at Downing Street to deliver a very important message to @Jeremy_Hunt.

The GB News #DontKillCash campaign is making a big impact! pic.twitter.com/NuxAscMay8

— Nigel Farage (@Nigel_Farage) August 17, 2023

The petition, which has over 300,000 pledges says on behalf of its signatories:

I call on the Government to introduce legislation to protect the status of cash as legal tender and as a widely accepted means of payment in the UK until at least 2050.

In the petition’s preamble, it states that “Britain is fast becoming a cashless society” and the situation has worsened considerably with the covid pandemic, when the government strongly discouraged the public from coming into contact with one another.

It warns that: “there are strong vested interests pushing for [cash] to be permanently replaced by debit and credit cards and other electronic payments. These cost you more in the long-run and enable 3rd parties to track you and your spending.”

Farage Tells Breitbart we are on the Verge of Banks Running ‘Word Checks’ on Customers Social Media https://t.co/5cicO3ypP7

— Breitbart London (@BreitbartLondon) August 4, 2023

Speaking on the petition on Thursday night after his visit to Downing Street, Mr Farage told viewers on his nightly television show that: “we want legal tender to remain legal tender and we fear we’re being driven towards a cashless society.”

Mr Farage reflected on the apparent moves by the government in response to his debanking revelations of the past two months, and noted with approval that something was actually happening. He said: “What is clear is that public opinion is very, very firmly behind us on this issue and the government for once are listening”.

Nevertheless, Farage has remained cautious, warning of an “establishment stitch-up” as regulators apparently slow-walk an investigation into the behaviour of banks. If unchecked, things could get considerably worse, Mr Farage has said, urging action now.

Debanking, a freshly entered neologism was not on the lips of many in the United Kingdom until June when Farage went public with the fact he was having his bank accounts shut down for nakedly political reasons, warning the public: “The establishment are trying to force me out of the UK by closing my bank accounts… If they can do it to me, they can do it to you too.”

Shame, Fear Meant Even Rich and Powerful Didn’t Admit They’d Been Debanked Until Farage Broke Storyhttps://t.co/HtvEFsy1Mb

— Breitbart London (@BreitbartLondon) July 31, 2023

Through the twists and turns of a rapidly building scandal, the scale to which debanking had already spread in the United Kingdom became apparent, and the heads of two banking houses — Coutts and NatWest — fell on their swords in disgrace over the way they had handled Mr Farage’s accounts and the subsequent media furore.

Different forms of debanking, from the nakedly political as in Mr Farage’s case, to the ‘Politically Exposed Persons’ European law holdover that’s seeing major public figures up to and including the Chancellor of the Exchequer himself have accounts denied or closed, to blue-collar workers dealing in cash being frozen out of the system have all since become public knowledge.

The issue has apparently churned away below the surface for some years, but it is now clear that it took a high-profile public figure revealing their own debanking experience for others to break cover. This, Mr Farage has said, was partly because of the shame associated with the stigma of being unable to hold a bank account, creating a sense of being a social outcast, but also fear of going public damaging a person’s credit score and making getting a replacement account elsewhere impossible.

Other Politicians Can Only Dream of Having the Influence of Nigel Farage, Says Top German Paperhttps://t.co/BB6TGNAdlB

— Breitbart London (@BreitbartLondon) July 29, 2023

COMMENTS

Please let us know if you're having issues with commenting.