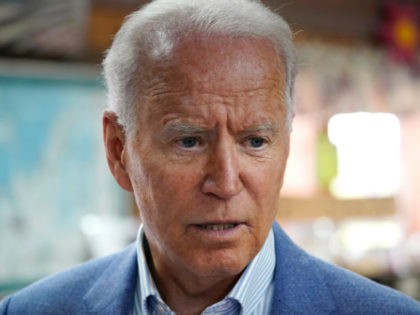

Supply Disruptions and Bidenflation Afflict Economy, Fed’s Beige Book Says

Shortages of workers and key inputs are slowing everything from retail to manufacturing while prices keep rising.

Shortages of workers and key inputs are slowing everything from retail to manufacturing while prices keep rising.

The so-called radical-left squad demanded President Joe Biden to oust Federal Reserve Chair Jerome Powell, urging him to appoint a new chair with radical views such as racial justice and climate activism.

The minutes of the Fed’s late July meeting appear to confirm the idea that Fed officials think the economy is strong enough to justify removing extraordinary monetary stimulus.

Excluding food and energy, consumer prices were 3.5 percent higher last month than they were in June 2020, the briskest pace of inflation since the summer of 1991 and an acceleration from a month ago.

Government-decreed lockdowns helped Big Tech gain trillions of dollars in valuation, said Carol Roth, author of The War on Small Business.

The Federal Reserve largely shrugged off inflation fears while saying Wednesday that the U.S. economy is strengthening. “Inflation has risen, largely reflecting transitory factors,” the Fed said in its monetary policy statement. The Fed said the economy is making progress

Teeka Tiwari, editor of a financial newsletter from the Palm Beach Research Group — and advertising sponsor of Breitbart News — said Monday that bitcoin and other cryptocurrencies will likely become checks against central banks’ printing of money.

Powell said Wednesday that “people need to have faith” that the Fed can stop inflation if it gets too high.

Economists surveyed this month by the Wall Street Journal raised their forecasts of how high inflation would go and for how long, compared with their previous expectations in April.

Desmond Lachman, an economist and senior fellow with the American Enterprise Institute (AEI), told Breitbart News on Sunday that the U.S. is beginning to resemble a Latin American country given its inflation, government spending, and printing of money.

Less than two weeks after announcing a doubling of its dividend and plans to buy back $18 billion of stock, Wells Fargo said that it is terminating its customers’ personal lines of credit.

U.S. stock prices and bond yields tumbled Thursday as doubts grew about the global economy’s ability to keep expanding rapidly.

Fed officials are not just divided over when to taper. They also disagree about how to reduce their bond purchases.

The Fed left its key interest rate target and bond buying program unchanged at the end of its two-day meeting Wednesday. But the projections of Fed officials show that they see more inflation and more growth by the end of the year than they did at the end of their March meeting.

A study by a trio of economists shows that the narrative accompanying official Federal Reserve forecasts can be used to predict economic surprises.

Federal Reserve Chairman Jerome Powell said Friday climate change is a threat to the global economy and called for the United States to lead a coordinated response to that threat.

Demand has surged faster than manufacturers, home builders, and retailers can expand to meet it, the latest Beige Book indicates.

“It may be time to at least think about thinking about tapering our $120 billion in monthly Treasury bond and mortgage-backed securities purchases,” Harker said.

A key measure of inflation accelerated to a faster-than-expected 3.1 percent annual gain in April, the Commerce Department reported Friday. The last time the core personal consumption expenditures index hit 3.1 percent was in May of 1992, when George H.

Fed officials discussed planning to have future discussiont to plan shrinking its $120 billion monthly bond-buying program, minutes from the central bank’s April meeting show.

The Federal Reserve on Wednesday acknowledged recent progress in employment and economic growth while saying it would keep its interest rate target near zero.

On the eve of Earth Day, 45 members of the U.S. House of Representatives delivered a letter to Special Presidential Envoy for Climate Change John Kerry accusing him of “abuse of power” for leaning on banks and other financial institutions to deny funding for fossil fuel-related entities in the name of fighting climate change.

Senator Pat Toomey on Monday sent a letter to the San Fran Fed, taking the regional Fed bank to task for the “seemingly sudden and alarming inclusion of social research that risks being of a bitterly partisan nature.”

The Fed chair sounded a bit more upbeat about the progress of the economic recovery on Tuesday.

Federal Reserve Vice Chair Randal Quarles issued a stern warning to banks on Monday about the necessity to stop using Libor interest rate benchmarks.

Federal Reserve officials raised their expectations for economic growth, labor market recovery, and inflation this year, data released Wednesday showed.

Businesses catering to pet owners had a good year as people adopted more pets and spent more time with their pets. That could reverse as the economy reopens.

The Federal Reserve’s systems for electronic money transfers suffered a widespread disruption Wednesday.

Federal Reserve Chair Jerome Powell emphasized the damage the economy has suffered due to the pandemic and stressed that there was still a long way to go to a full recovery.

The yield curve—the difference in yields for short-term and long-term debt—has sharpened dramatically in recent weeks as investors have sold off bonds maturing five-years or more into the future while shorter-term bonds have held steady.

In a speech in New York Wednesday, Fed chair Jerome Powell downplayed the risks of inflation and urged lawmakers to embrace higher spending to restore the labor market.

Her enormous speaking fees from Citadel raise questions about conflicts of interest.

Janet Yellen, the former chairwoman of the Federal Reserve who is now His Fraudulency Joe Biden’s Treasury Secretary, made millions off Wall Street “speaking fees” over the past two years. In some cases, she didn’t even have to show up to speak. Her appearance was “virtual.”

“We have not won this yet. We need to stay focused on it as a country and get there,” Fed chair Jerome Powell said

The struggle to maintain American sovereignty now has a new flashpoint: the Network for Greening the Financial System.

Republicans could not muster one vote against Yellen in the Senate Finance Committee.

Janet Yellen’s nomination marks a break with historical norms, even though few in Washington, D.C. seem to have noticed.

Trump was lambasted for criticizing the Fed. But as he leaves office, it’s clear Trump won his fight over monetary policy.

The Fed’s new projections indicate that the central bankers underestimated how quickly the economy would recover in the second half of this year.

Stocks and real estate pushed up the asset values of American households in the July through September period.