CNBC’s Sara Eisen: The Market Likes Trump, ‘A Lot of Upbeat Sentiment’

Thursday on ABC’s “The View,” CNBC host Sara Eisen said the stock market liked President Donald Trump, which is causing “a lot of upbeat sentiment from companies.”

Thursday on ABC’s “The View,” CNBC host Sara Eisen said the stock market liked President Donald Trump, which is causing “a lot of upbeat sentiment from companies.”

On this week’s broadcast of Fox News Channel’s “Sunday Morning Futures,” Treasury Secretary Scott Bessent said the Dow Jones Industrial Average hitting the 50,000 milestone was “telling you that Main Street is about to prosper.”

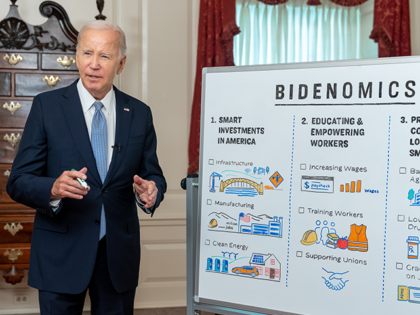

President Donald Trump touted the “Trump economic boom” is underway during his remarks at the Detroit Economic Club in Michigan Tuesday.

President Donald Trump touted 4.2 percent gross domestic product growth for quarter three on Tuesday, significantly outperforming expectations, but said stock markets no longer rise due to good news.

Cannabis stocks surged on Friday after the Washington Post reported that President Donald Trump is expected to push the government to “dramatically loosen” federal restrictions on marijuana.

President Donald Trump touted the U.S. economy Thursday during an Oval Office signing, highlighting a record-high stock market and falling gas prices.

Treasury Secretary Scott Bessent declared that the Trump administration “won’t negotiate” with China in response to stock market volatility, but because “we are doing what is best economically for the U.S.” after the Wall Street Journal reported otherwise.

Japan’s Nikkei stock index rose 4.7 percent to a record high of 47,944.76 on Monday, driven by a remarkable surge of investor optimism over the election of conservative Takaichi Sanae as leader of the Liberal Democratic Party (LDP), and most likely the first female prime minister of Japan.

Stocks rallied Thursday, shaking off concerns about the government shutdown for a second day.

While the government shutdown has captured the attention of the denizens of the nation’s capital, the actual financial capital and labor of the U.S. is likely to proceed as if nothing much has changed.

Trump’s critics insisted tariffs would be the spark that lit a global trade war. But the trade war never arrived.

During an interview on CBS News on Tuesday, Rep. Joyce Beatty (D-OH) argued that economic indices on the stock market, employment, and inflation are just being made up by the Trump administration and “what they’re reporting are just numbers and

President Donald Trump declared Thursday that the United States is officially “back” and called on the Federal Reserve to lower interest rates.

President Donald Trump has been stacking up the wins over the past two weeks, ranging from his peacemaking accomplishments in the Middle East and Africa to the major Supreme Court rulings in his favor.

The Baby Boomers built the bond bull, and heir retirement is dismantling it. But Washington still spends as if there’s an endless pool of capital waiting to buy Treasuries.

The anti-science freak-out predicting President Donald Trump’s tariffs would explode consumer prices has now been debunked as yet another legacy media hoax.

On Monday’s broadcast of the Fox News Channel’s “Ingraham Angle,” White House Senior Counselor for Trade and Manufacturing Peter Navarro said that the market is “finding a bottom” at the moment, predicted that the Dow Jones will surge in the

The market, like a poker player who stayed in the hand far too long, seemed to be operating under the assumption that Trump would eventually fold.

So, when critics say tariffs are just crony capitalism for incumbent firms, point them to the stock market. It’s not cheering. It’s panicking. Because this time, the rules really are changing.

If you’re looking for an explanation of why the stock market has been stumbling, the financial press has a ready-made answer: blame Trump’s tariffs.

Ontario Premier Doug Ford said Tuesday on CNN’s “News Central” that President Donald Trump’s 25% tariff on Canada is making the stock market go “downhill faster than the American bobsled team.”

A wise man once said that the best investors buy from pessimists and sell to optimists.

Chinese dictator Xi Jinping held a meeting with tech CEOs on Monday to discuss rebuilding China’s damaged economy and push back against America’s efforts to maintain high-tech supremacy.

President Donald Trump on Monday warned that China’s new DeepSeek chatbot should serve as a “wake-up call” to America’s artificial intelligence (A.I.) industry.

Chinese AI company DeepSeek has emerged as a potential challenger to U.S. tech giants, demonstrating breakthrough AI models that claim to offer performance comparable to leading offerings at a fraction of the cost. The entire U.S. market is taking a tumble on Monday morning as a result, but many analysts are skeptical of the company’s claims.

Shortly after delivering his inauguration address on Monday, President Donald Trump said 25-percent tariffs on goods from Canada and Mexico could be imposed as soon as February 1.

Congressional Democrats appeared to greatly enhance their wealth in 2024, despite only earning a yearly salary of $174,000.

Establishment Republican Dan Crenshaw (TX) again ranked among the best at trading stocks in Congress, a study by Unusual Whales found Tuesday.

A super-majority of Americans, across racial and ethnic groups, think the stock market is important, according to the latest survey by YouGov for the Economist.

A private company in China with a name that riffs on “Trump Victory” surged by ten percent in value on Monday and Tuesday, even as blue-chip stocks on the Chinese market slid by up to one percent.

Sen. Tammy Baldwin (D-WI) stated that people should “stay out” of her “personal life,” when confronted by CNN over her failure to disclose her partner’s financial assets.

A billionaire investor recently claimed the stock market is quite sure who will win the November presidential election.

Paul Pelosi, the husband of Rep. Nancy Pelosi (D-CA), sold between $500,000 and $1 million worth of Visa stock, according to public records, just weeks before the Justice Department launched a lawsuit against the credit card company on Tuesday.

Sen. Tammy Baldwin (D-WI) released a campaign ad in response to a report that revealed her bill banning senators and their spouses from buying stocks would not apply to her spouse.

Republican megadonor and hedge fund billionaire John Paulson revealed that he would pull his money out of the stock market if Vice President Kamala Harris wins the upcoming presidential election, pointing to “uncertainty” around her economic policies.

On Friday’s broadcast of Bloomberg’s “Balance of Power,” White House Council of Economic Advisers Chairman Jared Bernstein responded to the August jobs report by stating that “the market has an overreaction function. Today’s a pretty simple story, if you keep

The federal funds futures market is pricing in a cut in each of the remaining three meetings of the Federal Open Market Committee this year.

Financial disclosure forms filed by Sen. Jacky Rosen (D-NV) since 2018 have reportedly been missing information, according to her attorney.

Absent some economic catastrophe, there’s almost no chance of an emergency rate cut in August.

On Monday’s broadcast of “CNN Newsroom,” Rep. Ami Bera (D-CA) stated that the downturn in the stock market “is probably a market correction” after “an incredible run over the past few years” in the market. And that rising tensions in