U.S. Home Prices Fall For Third Straight Month

All of the 20 cities tracked by the S&P Dow Jones Indices experienced seasonally-adjusted month-over-month price declines.

All of the 20 cities tracked by the S&P Dow Jones Indices experienced seasonally-adjusted month-over-month price declines.

Fed policy of tightening did not transmit to the new homes market last month.

The weekly price for London residential rentals climbed to a record high in large part as a result of the elitist mass migration agenda.

The “A Christmas Story” house is up for sale in Cleveland, Ohio, after visitors enjoyed its museum and bed and breakfast for several years.

Republican J.D. Vance, running against Rep. Tim Ryan (D-OH) for the state’s open United States Senate seat, says the U.S. must “protect” American single-family homes and farmland from foreign investors like China and billionaires such as Bill Gates.

The Fed fight against inflation is battering the housing market.

Single-family housing starts in September were at a rate of 892,000, 4.7 percent below the revised August figure of 936,000. Compared with a year ago, single-family starts are down 18.8 percent.

A much deeper slump in home builder sentiment took hold in October.

Hunter Biden reached a $40 million real estate deal in 2012 with Russian billionaire and wife of the former mayor of Moscow, Yelena Baturina, while President Joe Biden was vice president.

The 30-year fixed mortgage rate rose to 6.92 percent on Thursday, higher than at any point during the subprime mortgage crisis of the mid-2000s.

Single-family home sales are down 19.2 percent compared with August of 2021.

A big jump in multifamily construction boosted starts in August.

Home prices are likely to keep declining as interest rates climb higher.

The Bank of America announced it will not require down payments on loans in certain primarily Black and Hispanic neighborhoods in five U.S. cities.

The Chinese Communist government slapped its bureaucratic panic buttons on Monday, announcing various “task forces” to deal with a crumbling national economy, particularly the record-high 19.9% youth unemployment rate recorded in July.

A sharp drop in mortgage rates in July probably explains the shallower drop in pending sales.

A much bigger drop than expected.

The Cambodian city of Sihanoukville was a major international resort destination before the Wuhan coronavirus pandemic crippled its tourism industry. The city is now littered with empty and half-finished “ghost buildings” abandoned by Chinese investors. According to local entrepreneurs, these unsightly gang-infested husks are keeping the tourism industry from making a comeback.

China’s economic reports from July paint a grim picture of an economy in free-fall, with virtually every metric of growth – or even stability – coming in far below expectations.

Former WeWork CEO and co-founder Adam Neumann is attempting to make a comeback in the form of a residential real-estate venture that has already lined up funding and is valued at more than $1 billion.

Construction of single-family homes has fallen below its prepandemic level.

Homebuilder sentiment weakened for the eighth straight month, falling into negative territory for the first time since the pandemic first hit.

A poll conducted by the Caixin news service on Monday found China’s economy foundering as the second half of 2022 began, with slower manufacturing activity, higher unemployment, and a depressed real estate market.

Lawmakers are concerned about a Chinese company’s purchase of farmland in North Dakota just miles away from Grand Forks Air Force Base.

China’s purchase of American homes and land is a “huge problem,” Republican Florida Gov. Ron DeSantis said in an interview.

Sales of new homes in the U.S. plunged 8.1 percent to a seasonally-adjusted annual rate of 590,000 in June, a far slower pace than expected by economists.

Chinese investors are gobbling up homes, farms and other properties in the U.S., statistics in a real estate market report show

Higher rates and high prices are clobbering demand for mortgages.

After backlash from politicians and the public, the European Union has abandoned plans to buy an $18 Million New York townhouse for its U.N. Ambassador.

Longer-term Treasury yields fell last week on recession feaers, dragging down mortgage rates.

Single-family home construction came to a standstill.

A report from a website focused on home buying shows the price of housing in the U.S. is soaring — up 21 percent since the start of 2021.

The rise in home costs has posed a challenge in purchasing homes for LGBTQ community members in particular, according to a recent CNBC real estate piece that drew ridicule for its misleading nature and “virtue signaling.”

High home prices and rising mortgage rates are pushing more people to rent, driving up rents.

The European Union is looking to spend $18 million on a massive 5,300ft2 New York residence for the bloc’s ambassador to the United Nations.

Home builders slammed on the brakes in May as interest rates and inflation soared.

Higher borrowing costs are pushing buyers out of the market.

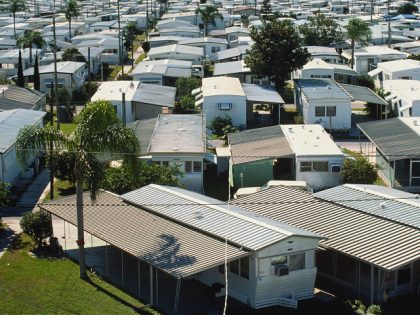

Manufactured homes have long been a way for lower-income people to become homeowners but now this demographic is also feeling the pressure of rising costs and many fear for their future.

The uncertainty of the U.S. economy under Joe Biden is also affecting those in the market for buying a home.

Home prices are rising at a record pace.