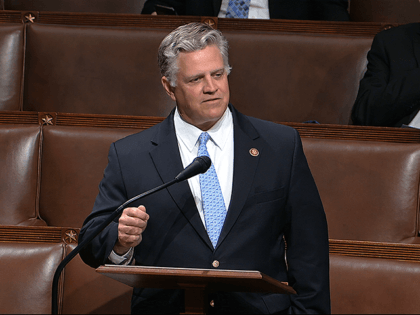

Exclusive — Rep. Drew Ferguson: ‘Taxpayer Dollars Are Going Directly to Amazon’s Bottom Line’ via Democrats’ ‘Green Energy Agenda’

Democrats enrich companies like Amazon with “green energy” tax credits while posturing as economic populists, Rep. Drew Ferguson (R-GA) said.