Breitbart Business Digest: The Great Reprivatization and the Amazing January Jobs Report

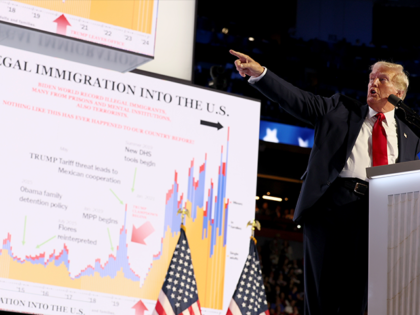

The acceleration of America’s economic growth under President Trump is driving up hiring without the need for the arrival of hundreds of thousands of workers crossing our borders in defiance of our immigration laws.