Crypto Winter: 50%+ of Bitcoin Addresses Now in the Red

According to a recent report from Coindesk, more than 50 percent of Bitcoin addresses are now in the red for the first time since the start of the coronavirus-induced crash of March 2020.

According to a recent report from Coindesk, more than 50 percent of Bitcoin addresses are now in the red for the first time since the start of the coronavirus-induced crash of March 2020.

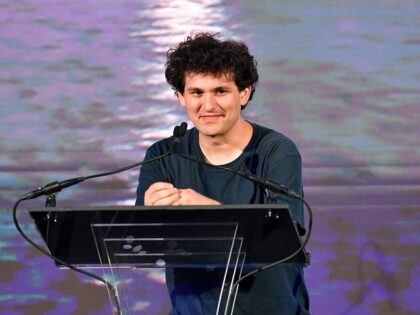

In a recent article, the Wall Street Journal spoke to a number of FTX employees about the effect the crypto exchange’s collapse had on them. One executive threw up after learning that customers’ money was missing while others expressed anger and resentment towards crypto failure and Democrat super donor Sam Bankman-Fried.

Cryptocurrency lending firm Genesis Global Capital has reportedly asked crypto exchange Binance and private equity firm Apollo Global Management for cash. Genesis is faltering as the FTX contagion continues to spread throughout the cryptocurrency world.

FTX, the cryptocurrency exchange founded by Democrat super donor Sam Bankman-Fried that recently filed for bankruptcy, reportedly owed $3.1 billion to its 50 largest creditors.

The Wall Street Journal reports that during a funding round that raised $420 million for the cryptocurrency exchange FTX, almost three-quarters of the money went directly to founder and Democrat super donor Sam Bankman-Fried.

John Ray III, the newly appointed CEO of FTX who previously oversaw the restructuring of the infamous energy company Enron, says that he has never before seen “such a complete failure” of corporate controls as he has with FTX.

Disgraced cryptocurrency exchange FTX founder and Democrat super donor Sam Bankman-Fried lent $1 billion to himself through his hedge fund Alameda Research, which likely sourced the money from FTX customer funds.

The new CEO of FTX, John Ray, III, revealed several wild and shocking items found in the collapsed company’s bankruptcy filing, which include the founder and former CEO Sam Bankman-Fried lending himself $1 billion, and FTX corporate funds being used to buy personal homes, among other things.

Disgraced FTX founder and Democrat super donor Sam Bankman-Fried has finally begun detailing his version of the events surrounding the downfall of the cryptocurrency exchange, at one point telling a journalist via Twitter DM’s that his “effective altruism” ethos was largely an act.

FTX founder Sam Bankman-Fried may have inflated the amount of funds on his failed exchange by “exaggerating the returns or stuffing them,” Breitbart Economics Editor John Carney explained.

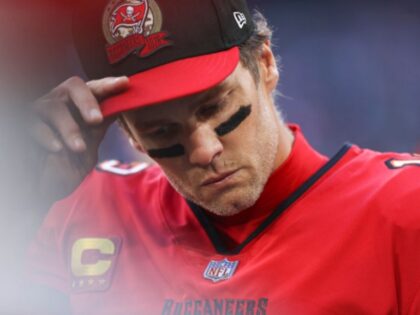

NFL star Tom Brady, his ex-wife model Gisele Bündchen, comedian Larry David, and other celebrities are being sued by cryptocurrency investors following the collapse of FTX.

According to people familiar with the matter, FTX founder and Democrat super donor Sam Bankman-Fried still believes that he can raise enough money to make users whole, even though the cryptocurrency exchange filed for bankruptcy last week.

BlockFi, a platform for crypto-backed loans and trading, may also face bankruptcy due to its exposure to FTX, the beleaguered cryptocurrency exchange that was led by Democrat megadonor Sam Bankman-Fried.

The New York Times appears to be treating disgraced crypto CEO and Democrat megadonor Sam Bankman-Fried, accused of mishandling FTX customer investments on a massive scale, with kid gloves.

Shark Tank star and venture capitalist Kevin O’Leary recently stated that he planned an attempt to save cryptocurrency exchange FTX hours before it filed for bankruptcy but held off following comments from SEC Chairman Gary Gensler.

The balance sheet of FTX, the bankrupt cryptocurrency exchange founded by Democrat megadonor Sam Bankman-Fried, includes $7.4 million of a cryptocurrency token called “TRUMPLOSE.”

The new call for a crypto super fund sounds a lot like a similar proposal launched in 2007 before the ensuing global financial crisis.

Following the spectacular collapse of FTX and its Democrat super-donor founder Sam Bankman-Fried, other centralized cryptocurrency exchanges are scrambling to shore up their reputation and contain the fallout.

Sam Bankman-Fried’s trading firm, Alameda Research, allegedly traded billions of dollars from FTX customers’ accounts and leveraged the crypto exchange’s native token as collateral.

Following the collapse of the cryptocurrency exchange FTX, at least $1 billion in investor assets seems to be missing according to multiple reports.

The best that Sam Bankman-Fried could hope for at the start of this week was that his crypto exchange FTX would turn out to be the equivalent of Bear Stearns. Instead, it turned out to be Lehman Brothers.

Sam Bankman-Fried’s cryptocurrency exchange FTX has reportedly filed for Chapter 11 bankruptcy in the U.S. following a week of significant scandals and upset in the cryptocurrency space. The crypto boss and Democrat megadonor popularly known as “SBF” subsequently resigned.

Kim Kardashian has agreed to pay $1.26 million to settle Securities and Exchange Commission charges that she promoted a cryptocurrency on Instagram without disclosing that she’d been paid $250,000 to do so.

Coinbase, the cryptocurrency exchange that spent millions of dollars on Super Bowl ads just months ago, is now laying off thousands of employees as cryptocurrency prices crash yet again. Coinbase isn’t alone in this reversal of fortune — Crypto.com is laying off staff just months after its widely mocked Super Bowl ad starring Matt Damon.

Crypto trading platform Coinbase will cut 18 percent of its staff with CEO Brian Armstrong warning of a worldwide recession and the possibility of a “crypto winter.”

As cryptocurrency continues to crash in value, Matt Damon is being mocked for starring in a commercial for Crypto.com less than a year ago.

The UK’s Royal Mint has been tasked by the Treasury Department to create an NFT in the latest move towards a cashless society.

Cryptocurrency expert Teeka Tiwari’s PickoftheDecade.com presentation helps investors understand the revolutionary blockchain technology powering the crypto market.

House Financial Services Committee Ranking Member Patrick McHenry (R-NC) told Breitbart News exclusively that Republicans need to stop President Joe Biden and progressives’ “nefarious” assault on bitcoin and cryptocurrencies.

A class action lawsuit is accusing Kim Kardashian and Floyd Mayweather of artificially inflating the price of the cryptocurrency “EthereumMax” and making “false or misleading statements” about the token. The cryptocurrency has crashed 97 percent since June, leading investors to accuse the team behind the token and their celebrity partners of engaging in a “pump and dump” operation.

Shares of TeraWulf, a cryptocurrency miner backed by actress Gwyneth Paltrow — who sells candles that she says smell like her genitalia — fell sharply during the company’s public trading debut on the Nasdaq stock market.

Playboy playmate Jessica Vaugn credited coronavirus lockdowns as driving her “red-pilling” and political awakening from a “mainstream slumber.”

Cryptocurrency expert Teeka Tiwari’s PickoftheDecade.com presentation helps investors understand the revolutionary blockchain technology powering the crypto market.

The Electronic Frontier Foundation (EFF), an organization that advocates for the rights of digital consumers, has warned that plans for a cryptocurrency tax in the massive Democrat-pushed infrastructure bill risks stifling the emergent crypto market in the U.S. and exposing the personal data of those engaged in it.

Teeka Tiwari, editor of a financial newsletter from the Palm Beach Research Group — and advertising sponsor of Breitbart News — said Monday that bitcoin and other cryptocurrencies will likely become checks against central banks’ printing of money.

Why do some experts see cryptocurrency as this decade’s must-have investment? What exactly is crypto and how can average investors navigate the crypto market’s volatility? To get answers, Breitbart News Editor-in-Chief Alex Marlow spoke with crypto investment expert Teeka Tiwari, whose PickoftheDecade.com presentation and Palm Beach Letter provides investors with a clear explanation of the crypto market and how they can maximize their benefits from this new asset class.

Binance, one of the world’s largest centralized cryptocurrency exchanges has been banned from operating regulated activities in the United Kindom by the Financial Conduct Authority, the country’s financial and markets regulator.

The The National Republican Congressional Committee (NRCC), the official GOP body which works to elect Republican members of congress, will accept donations in cryptocurrency, members of the committee told Axios.

In a recent article, the Byte by Futurism outlines the opinions of digital artist Beeple, otherwise known as Mike Winkelmann, on the recent non-fungible token (NFT) craze after he sold his own NFT for a record-breaking $69 million. The artist called the crypto craze a “bubble” despite his massive profits.

BERLIN (AP) — A 33-year-old Italian citizen was going on trial Friday in Berlin on allegations that he threatened to blow up a British National Health Service hospital unless he was paid off with 10 million pounds ($13.2 million) in crypto currency.