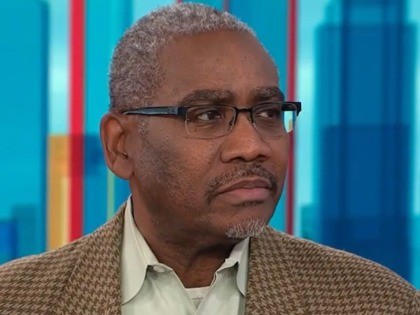

Khanna: Importers May Have Reduced Prices to Factor in Tariffs, ‘Penalty Was Paid by the Consumers’

On Monday’s broadcast of MS NOW’s “The Weeknight,” Rep. Ro Khanna (D-CA) discussed tariffs and said that “the importers may have reduced the price to factor in the tariff. So, those companies may not have actually been penalized. The penalty