White House Shares Americans’ Feedback on Trump Tax Cuts: ‘They Finally Put Some Money in Our Pocket’

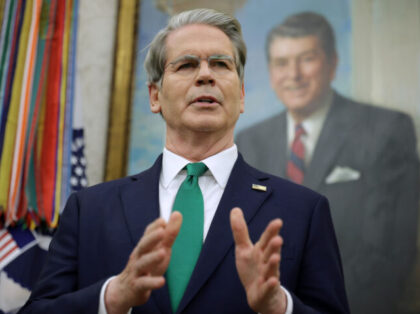

White House Press Secretary Karoline Leavitt shared feedback from Americans on President Donald Trump’s “Working Families Tax Cuts,” including people who said they’ve saved thousands of dollars.