War!

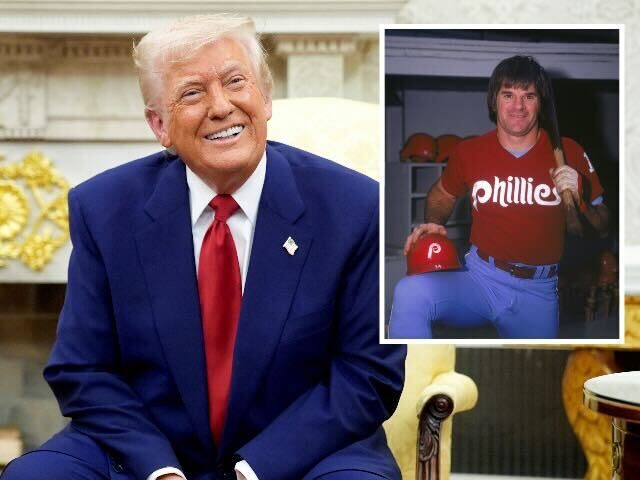

Musk Says ‘Yes’ to Donald Trump’s Impeachment

Declares He Won Election for MAGA!…

…Claims POTUS in Epstein Files

Trump Fires Back: I DOGE’D You

Musk Will Have *His* Pork Cut?

After campaigning for Donald Trump, spending millions to aid his election, and working in his administration, Elon Musk now says Trump should be impeached. In a Thursday afternoon X post amid a historic falling out between the two former allies,